Dutch Insurance Company Forced To Pay Full Rolex Market Price To Theft Victim

Today, I’d like to share an interesting verdict from the Dutch Institute for Financial Disputes (Kifid) in a case between an insurance company (Achmea Schadeverzekeringen N.V.) and a consumer.

The consumer had an insurance policy with an additional clause for valuable goods. Importantly, this additional insurance also covered the loss/theft of valuable goods outside the house.

A stolen Rolex Sky-Dweller

The client of Achmea Schadeverzekeringen lost his precious Rolex Sky-Dweller due to theft on the night of April 26th/27th, 2022. On the 27th, the watch owner filed a report with the police. At the end of that month, he also reported the theft to his insurance company. Achmea Schadeverzekeringen investigated the insured client’s claim on August 22nd, 2022. One month later, the company approved his claim and reimbursed him the retail price of the Rolex Sky-Dweller (€14,300 at the time), minus the client’s €100 deductible.

Paying the market price

Now, here is where it gets interesting. After all, as we know, one does not simply walk into a Rolex AD and purchase a Sky-Dweller from stock. On October 4th, 2022, the theft victim went to an authorized (!) dealer and asked for the same Rolex Sky-Dweller he had previously owned for its retail price of €14,300. In this case, the authorized dealer told him that the waiting time for a Rolex Sky-Dweller was, at a minimum, three years. However (mind the “crook alert”), the authorized Rolex dealer offered him the Sky-Dweller for €25,000 so he could take it home immediately. The theft victim took the offer and went home with his new watch.

The authorized Rolex dealer’s scamming behavior is not today’s topic, by the way.

An additional claim

The insurance company’s client then claimed another €10,700 to make up for the total of €25,000. After a short investigation by Achmea Schadeverzekeringen’s jewelry expert, the company rejected the claim as the expert believed that the client could indeed buy the watch for its €14,300 retail price. Based on this rejection, the client filed a complaint with the Dutch Institute for Financial Disputes (Kifid). The terms and conditions of his agreement with the insurance company read that the client would be reimbursed with an amount enabling him to buy an exact replacement immediately.

The insurance company again claimed that the consumer could buy the watch for €14,300 through an official Rolex dealer but had to consider the waiting time. However, the consumer had decided not to wait for the communicated three-year minimum and spent €10,700 more than he was reimbursed. The insurance company believed that it was not financially liable for his unwillingness to wait and the difference between the market and retail prices.

A complaint filed at the Dutch Institute for Financial Disputes

Without going into the legal mumbo jumbo, the Dutch Institute for Financial Disputes (Kifid) decided to take a closer look at the terms and conditions of the insurance policy and how to interpret them. According to Dutch law, if there’s unclarity in such an agreement between an insurance company and a consumer, the consumer’s rights prevail. This means that the text will be interpreted in a way that is most favorable to the consumer.

In the agreements, the interpretation of this text was the subject of discussion:

“What do we pay if the insured cannot recover the personal belongings?

The amount to buy the same items now.

– The items are less than one year old.”

Ruled in favor of the consumer

It all came down to the definition of “buy.” The precise nuance of this term was not explained in the terms and conditions of the insurance company. Objectively, “buy” means to “get goods for money.” However, the Dutch Institute for Financial Disputes believed that according to the terms and conditions (and lack of proper definitions), it could also be interpreted as “buying and owning (now).” As the insurance company did not clarify the exact meaning of “buy” in its conditions, the interpretation should be favorable to the consumer. This means that he could not only pay for the watch but also own it now without having to wait at least three years.

Upfront, the consumer and insurance company decided that the verdict would be binding. Thus, the insurance company now has to reimburse the client for the additional €10,700.

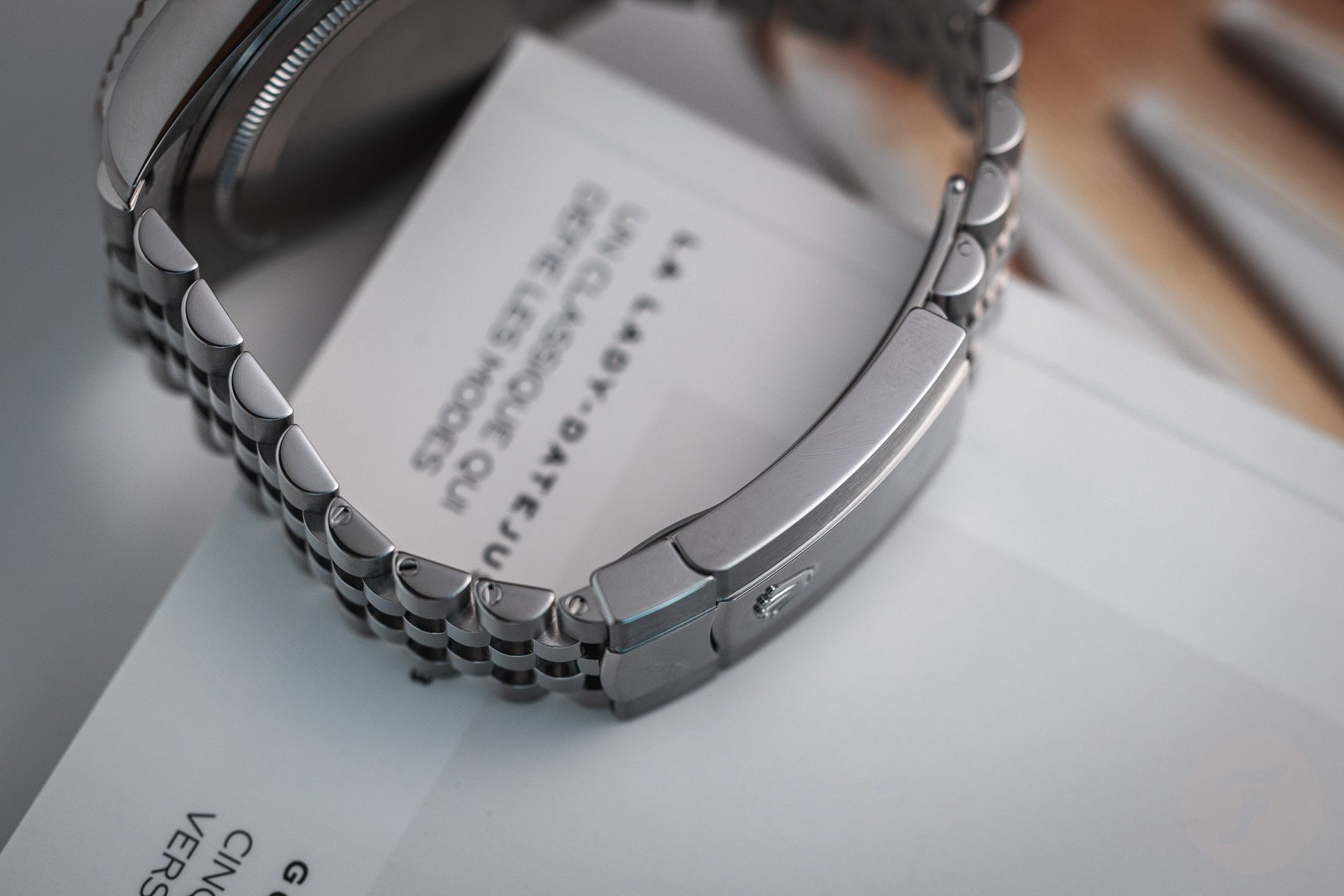

*The images in this story are for illustrative purposes only. The current retail price of a steel Rolex Sky-Dweller is €16,200 on an Oyster bracelet and €16,400 on a Jubilee bracelet.