Measuring The Success Of A Watch Brand By Its Pre-Owned Prices

More than once, I’ve come across comments below articles and posts that try to measure the success of a watch brand by the resale value of its watches on the pre-owned market. But does it make sense to measure a brand’s performance this way? Is there a link between the revenue of a watch brand based on its new products and the prices on the secondary watch market?

Traditional metrics to measure success

When analyzing brands’ success, traditional metrics like (estimated) turnover figures and market share often dominate articles about this topic. However, an insightful indicator of a brand’s performance might also be in the pre-owned watch market. This market provides valuable insights into customers’ preferences and brand popularity.

Before diving into the pre-owned market and brands’ performance, I’d like to give you some generic numbers from watch companies. Unfortunately, only a few brands communicate numbers regarding annual sales or revenue. However, Audemars Piguet let us know that the company produced 50,001 watches and brought in revenue of just over CHF 2 billion in 2022.

Reports on the Swiss watch industry

Consulting companies like Morgan Stanley, in collaboration with LuxeConsult, publish reports on the Swiss watch industry. They often base their numbers on the Swiss exports that the Federation of the Swiss Watch Industry communicates. In its 2022 report, Morgan Stanley added data on the pre-owned market from websites like WatchCharts to give an idea of the popularity of specific watch models.

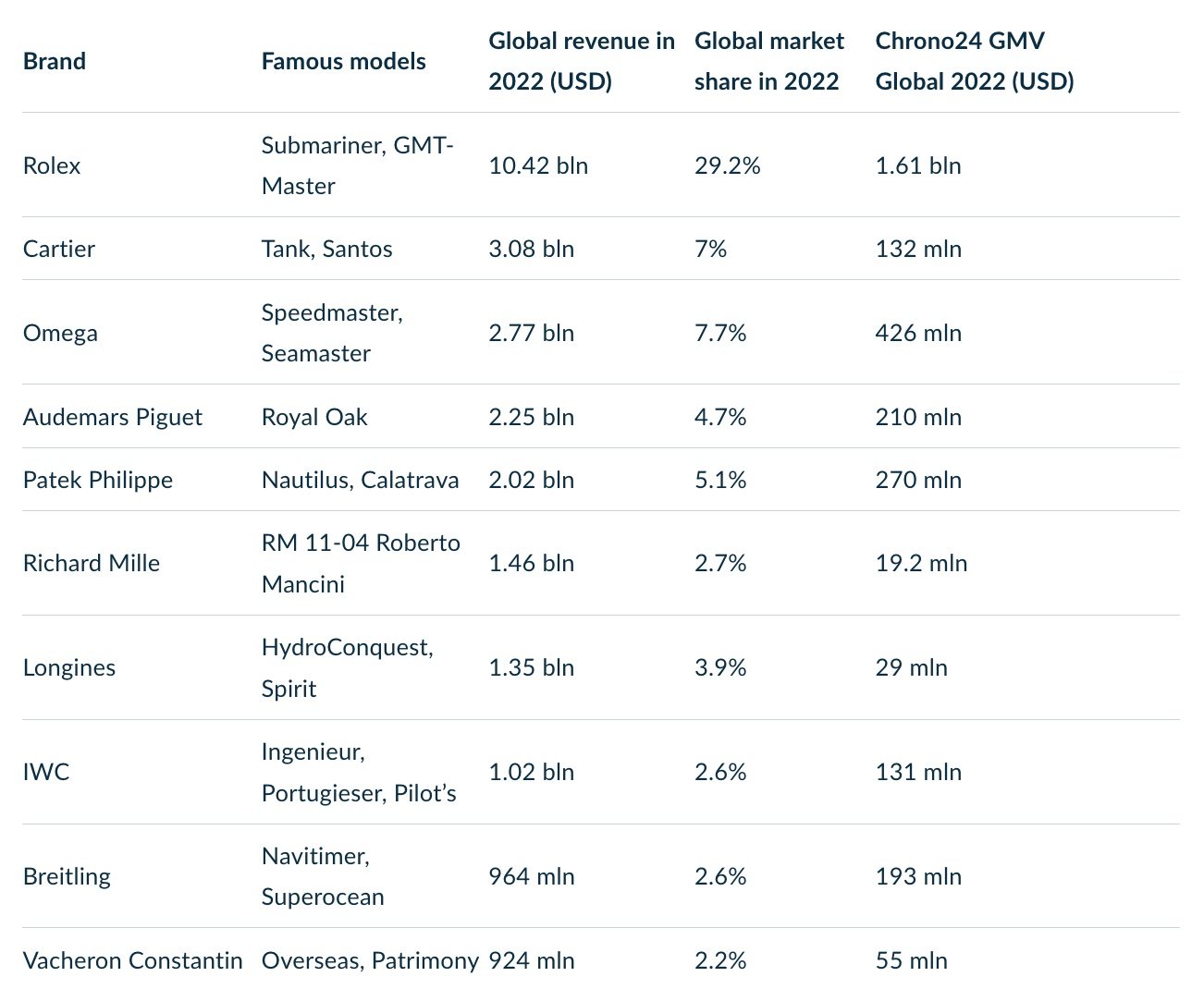

WatchCharts also uses data from selling platforms like forums (Reddit, WatchUSeek, etc.), eBay, Rakuten Japan, and Carousell. Watch-trading sites like Chrono24 have reports that also look at Morgan Stanley’s numbers as well as their own transaction data. In a recent publication by Chrono24, we see that there’s quite a mismatch between the numbers communicated based on Swiss exports and the transactions on the Chrono24 platform.

Source: Morgan Stanley/Chrono24

Secondary-market numbers

Let’s look at an excerpt of an overview that Chrono24 recently published, using Morgan Stanley data and the company’s own. As you’ve probably seen from that report (reprinted many times), Rolex is the #1 watch brand in terms of revenue. In the past, Omega held second place. But in 2020, according to Morgan Stanley’s analysis, Cartier took second place, and Omega followed. Chrono24 published 2022 numbers in its overview (also from Morgan Stanley), where Rolex led with CHF 9.3 billion in revenue, Cartier followed with CHF 2.75 billion, and Omega came in third with CHF 2.47 billion.

But Chrono24 also examined its own 2022 data, analyzing the transactions (officially, gross merchandise volume) on the platform per brand. Rolex is unmistakably #1, bringing in a whopping USD 1.61 billion in transaction volume. But on Chrono24, Cartier isn’t #2. That spot goes to Omega! Chrono24 sold USD 426 million worth of Omega watches, whereas Cartier had a transaction volume of USD 132 million. Between those two brands, there was Patek Philippe with USD 280 million, Audemars Piguet with USD 210 million, and Breitling with USD 193 million. Therefore, on Chrono24, Cartier would rank sixth based on transaction volume.

Putting the numbers in perspective

There are several factors to take into account, of course. First of all, not only new watches are traded on Chrono24. In fact, the majority are pre-owned or vintage. The supply of new and pre-owned Cartier pieces might just be lower. In fact, at the time of writing this, there are 16,983 Cartier watches on offer there versus 40,067 Omega watches. And then there’s the value per item, of course. There are fewer watches available from Audemars Piguet and Patek Philippe than Cartier on Chrono24, but the value per watch is higher.

The above was a bit off-topic, but I thought it would be good to give you some context for where these often-shared numbers come from. Although the Morgan Stanley report is largely based on the Swiss export numbers (which use the wholesale prices, not the retail prices), it is probably still the best thing to use when most brands refrain from communicating real numbers. The retail value published by Morgan Stanley is “implied,” according to the company’s own reports. This also leads me to believe that we should take some of the numbers with a grain of salt, especially when brands rank close to each other. However, these Morgan Stanley reports are probably the most accurate information there is at hand when it comes to brands’ turnover.

The pre-owned market as an indicator of success

Let’s get back to the topic of measuring the success of a brand differently. As mentioned in the introduction of this article, watch enthusiasts like to use the value of a pre-owned watch (or gray-market value, even) as an instrument to see how well a brand is doing in general. On one hand, I understand this approach. I also know that some brands like to use the value of their watches on the pre-owned/vintage market to determine (or acknowledge) the success of their brand or a certain watch.

The most obvious example is Rolex. Nearly every model the brand produces has a higher resale value than its retail price. In the past, this was just the case for stainless steel Daytona models and some of the latest releases. Once the novelty was gone, those also returned to their retail price (again). Today, however, nearly all Rolex watches are offered above the retail price on the pre-owned and gray markets. I assume you understand the gray market, but if you don’t, it consists of new and unworn watches sold by non-authorized resellers/dealers.

And in my opinion, the most obvious example (Rolex) is also the worst example. It is the only watch brand out there with this specific “performance.” Other watch brands also have models or collections that are constantly in demand, hard to get, or force you to be on waitlists, but not to this extent. Patek Philippe probably comes in a close second.

Breitling is a successful brand

But does the fact that a watch model sells for a fraction of the retail price on the pre-owned or gray market mean that the brand is unsuccessful? We have seen that Breitling has been doing very well over the past 5–6 years, with Morgan Stanley reporting an increase in the brand’s turnover from CHF 470 million in 2020 to CHF 860 million in 2022. However, if we look at a Chronomat Automatic GMT 40, for example, with a retail price of €5,900, prices on the pre-owned and gray markets are around €3,500 and up. Considering the discounts that are possible with this model, you could infer that there is more supply than demand. But does it mean that the brand is not doing well?

Let’s look at the Breitling Navitimer B02 Chronographe 41 Cosmonaute, admittedly, a limited edition of 362 pieces, which had a retail price of €11,450. They are being offered on the pre-owned market for well over €17,000. The latter shows that Breitling knows how to please a specific portion of its customers.

It still doesn’t answer the question of whether you can measure the success of a brand, of course, but it does show that a brand’s model can be very much in demand. Based on the Morgan Stanley report with historical data, we see that Breitling shifted up in position from #19 in 2017 to #9 in 2022. Breitling appears to be successful based both on the export numbers and also the popularity of some of its models within the pre-owned market.

Tudor on the pre-owned market

Another good example is Tudor. If we look at the Morgan Stanley 2022 watch report, it shows that Tudor has been staying very stable at position #15 since 2020 (coming from outside the top 20 in 2018). This does not indicate that #15 isn’t a good position because, despite not moving up in the ranking, the brand showed growth in turnover from CHF 390 million to CHF 510 million in 2021 and CHF 570 million in 2022.

Aside from the Morgan Stanley numbers, Tudor is doing very well in the perception of enthusiasts and collectors. And not only that, but professional resellers also shared with us that they have high hopes for the future of this brand. And finally, some of the models are simply difficult to get. For example, the demand for the Tudor Pelagos FXD seems to be higher than the supply. On the pre-owned market, though, we see that a Tudor Black Bay 58 (retail price €3,950) starts at approximately €3,000. For example, a Tudor Black Bay GMT M79830RB-0001, with a retail price of €4,270, can be had for a little under €4,000. With Tudor, we also see that new models will be difficult at first and, as time passes, become easier to obtain.

Can we measure success via the pre-owned market?

It is incredibly difficult to say whether a brand is successful based on the pre-owned market alone. The only actual number indicating a brand’s success is the profit a watch brand makes, but those numbers aren’t disclosed. Turnover is the next best thing, but it can sometimes be deceiving. Watch brands (and Morgan Stanley) often communicate numbers based on “sell-in.” Sell-in means these watches are sold to distributors, boutiques, and authorized dealers — in short, B2B. This number can be “inflated” as the sell-out (sales to customers, B2C) might differ. It’s a pointer because, if a brand is unsuccessful, the sell-in will also be low.

Can we measure the success of a brand through its pre-owned-market prices? “Not necessarily” would be my answer. These prices do say something about the demand for a brand or a certain model. Based on the importance of that model for a brand, they also may indicate whether the brand is successful. The bottom line, though, is that the most accurate indicator of success will always be profit. We can try to measure a brand’s success via the pre-owned market, auction results, and exposure in media, but in the end, it’s about the net profit. A brand with watches on the pre-owned market with prices substantially lower than the retail prices might still be profitable overall. If there’s one thing the pre-owned market prices do indicate, it is the relevance of a watch brand or model.

What are your thoughts on this topic? Feel free to contribute in the comments below.