Rolex Prices In The Current Day — What Generation Of Rolex Models Is The Smartest Buy?

In 2022, the simple truth is that it is close to impossible to buy a new Rolex at an authorized dealer. Whether we like it or not, such is life today. To add to the confusion, we have seen a pull-back in Rolex prices (and in the broader watch market) recently. It seems that the hysteria is quieting down a tad. This begs the question: what is the smart buy in today’s market? Should you pay over retail for a current-gen model? Should you hunt down a last-gen iteration? Or would neo- or true vintage be a better option? Let’s have a look!

Just as a disclaimer up front: the “smart” buy is, of course, always the watch you want most. In the end, that is all that matters. In this article, however, we will look at the financial side of the equation. What is going on with prices and what does it mean for you as a buyer? Price information for this article is sourced from Chrono24. Please take all amounts and percentages as rough indications. We are talking averages and estimations here to paint a general picture. I am only looking at two models for the same reason. I am not aiming to produce a precise financial market report. If that is what you are looking for, stop reading here. With that out the way, let’s get stuck in.

The watch market pull-back

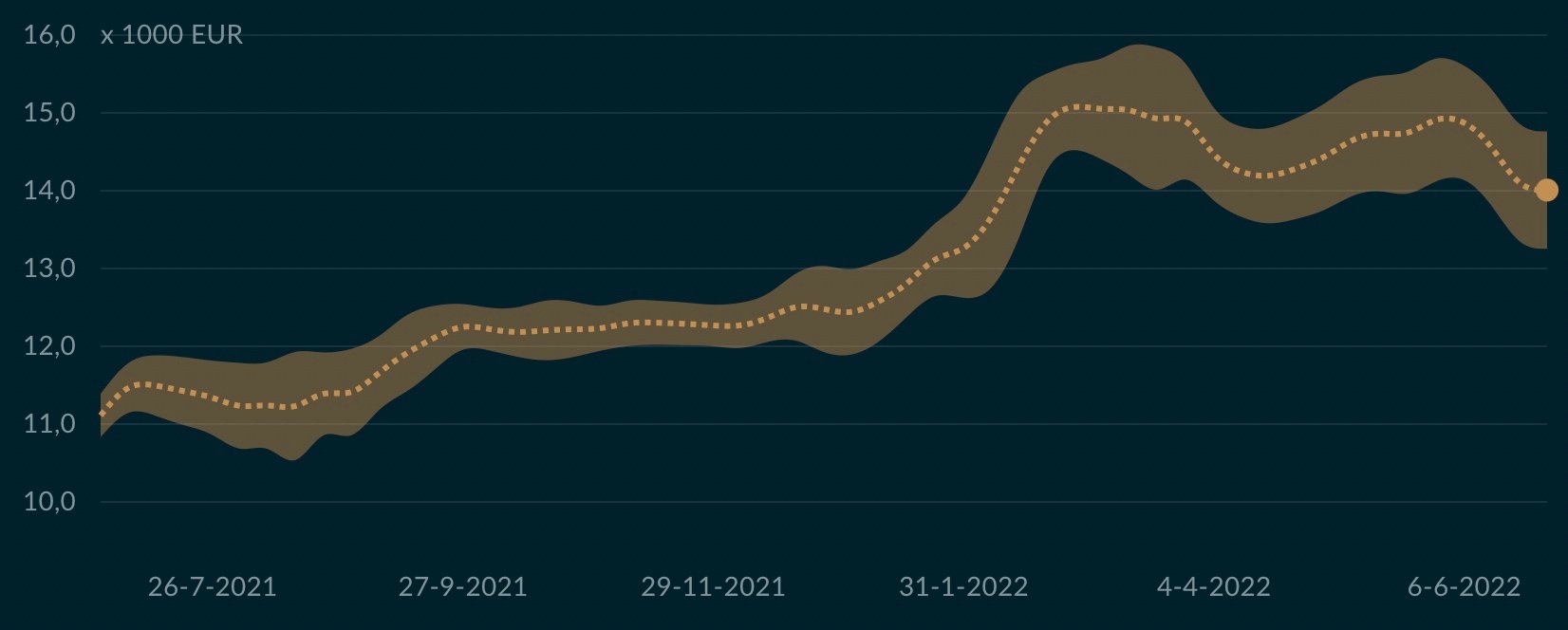

The first quarter of 2022 saw Rolex prices reach new highs. With authorized dealers reporting zero stock for most models, you would have to resort to the secondhand or gray markets, where prices soared. At its peak, a current-gen black no-date Submariner commanded just over €15,000. If you could find one, that is. That is a premium of more than 75% over its €8,500 RRP. At the time of writing, you can find an unworn example just below €14,000. This equates to a pull-back of about 7%.

The cause of this decline is likely the fact that prices had been inflated by speculation and outside investors. They were lured in by the gold rush caused by greater-than-usual shortages caused by COVID. Whereas earlier, a more gradual long-term growth was caused by a growing community of aficionados and collectors as well as the general public buying Rolex (steadily growing demand) and the limited supply by Rolex, this latest spurt was not quite so sustainable. When pretty much all investment classes took a big hit in May this year (2022), watches, and Rolex in particular, saw a correction too.

With artificial inflation as strong as it was here, the effects of a correction are amplified. Investors will cash out, which puts a lot of watches on the market at once. This then further pulls prices down. You ask why collectors dislike investors? Well, here is your answer.

Rolex prices went down, but so did demand. Both the transaction volume and value went down. Interestingly, the slump was not even across the board. Some watches were hit harder than others. And so, buying a Rolex today is a different game than it was two months ago.

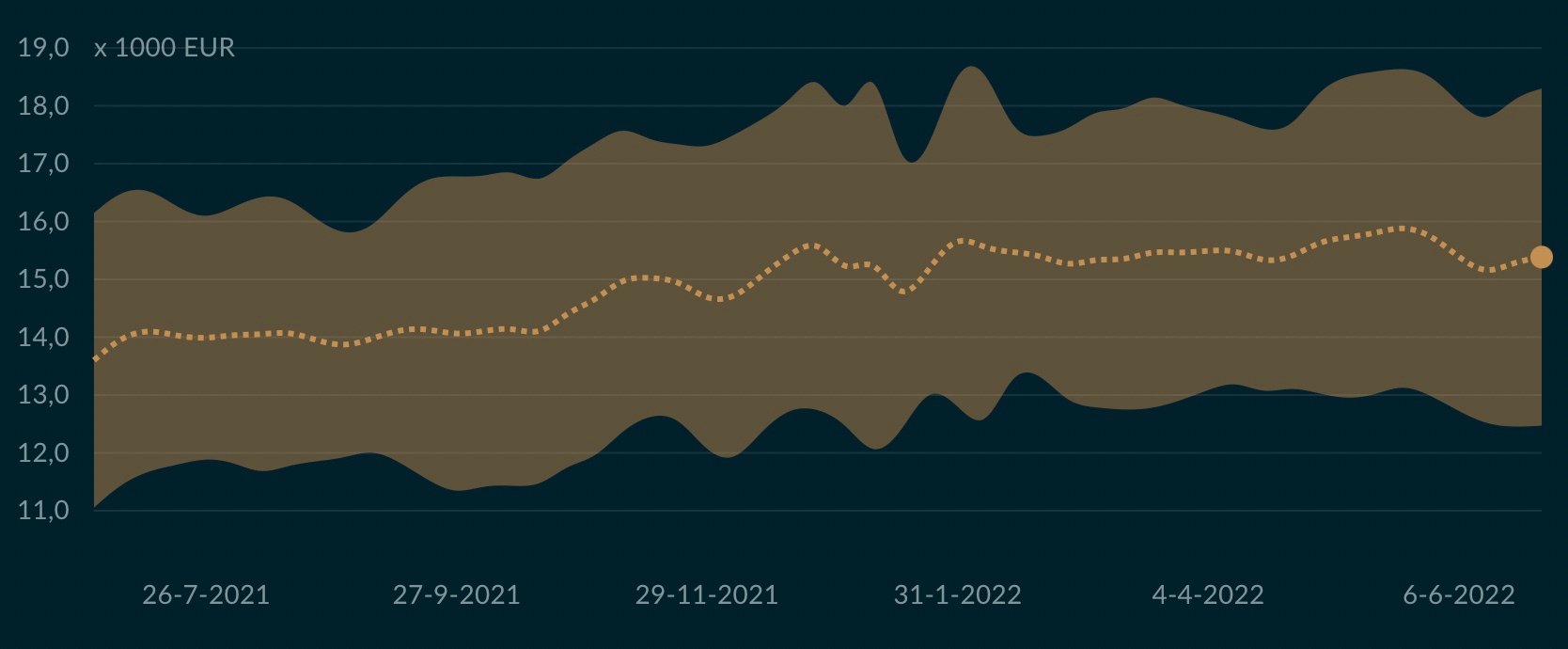

- One-year price development of Submariner ref. 124060

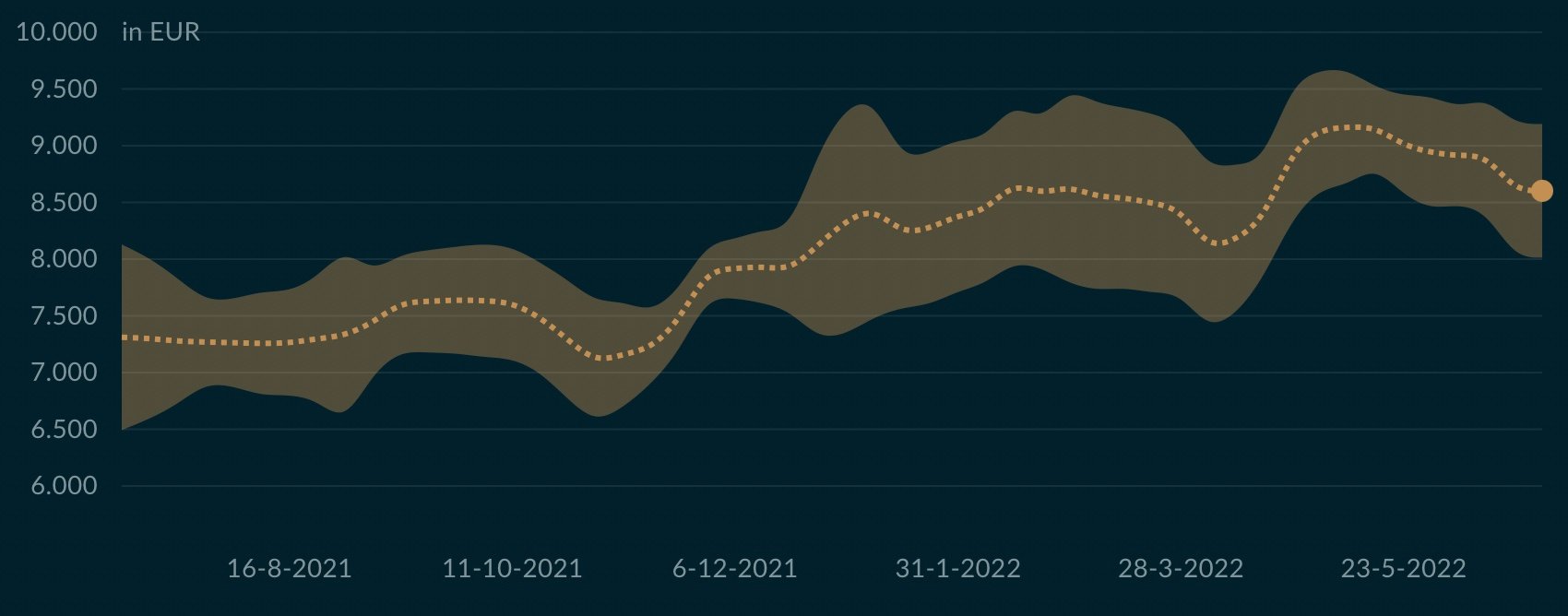

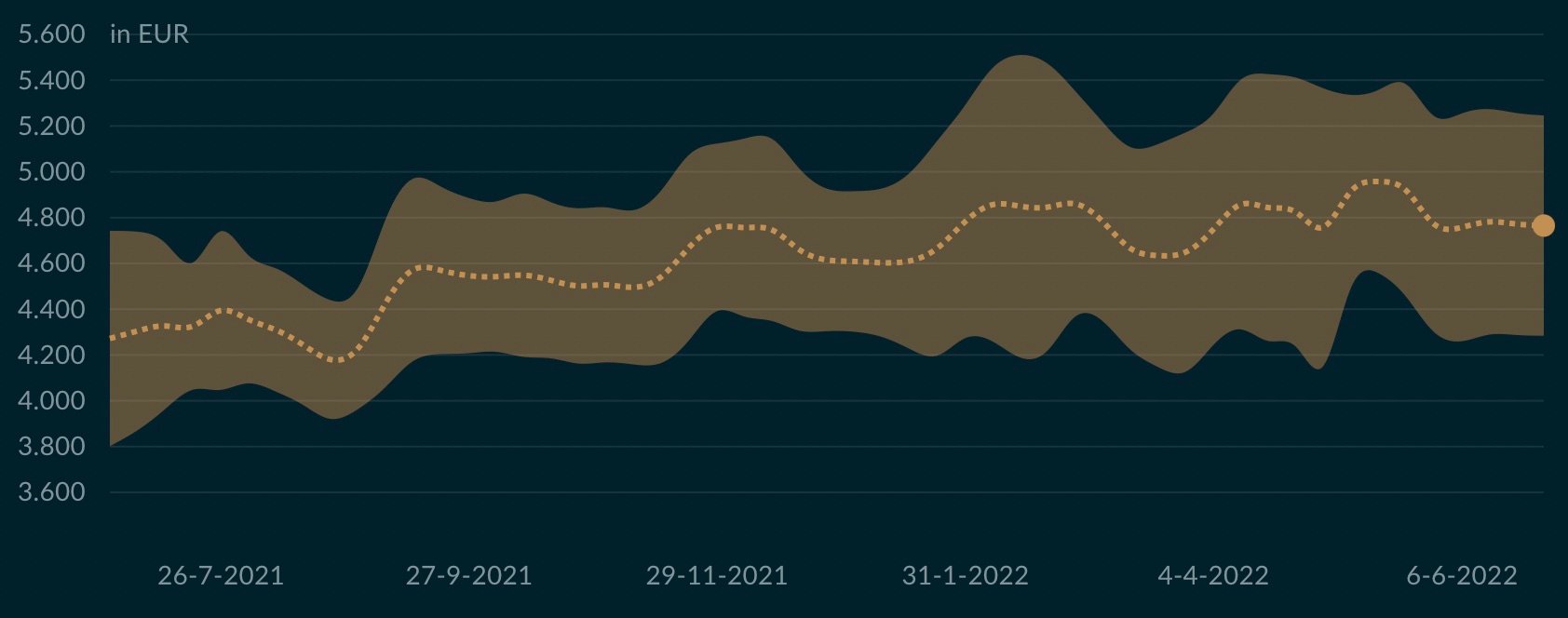

- One-year price development of Datejust ref. 126200

Current versus previous-gen Rolex prices

As a sample, I pulled some figures on the current-gen Submariner ref. 124060 and a steel Datejust ref. 126200. Both trade well above their respective RRPs. Both, however, took a dive between 6 and 7% over the past month. That might sound painful. However, compared to July 2021, that is still a growth of 21% for the Sub and 18% for the DJ. Yes, we may have been due a slight correction.

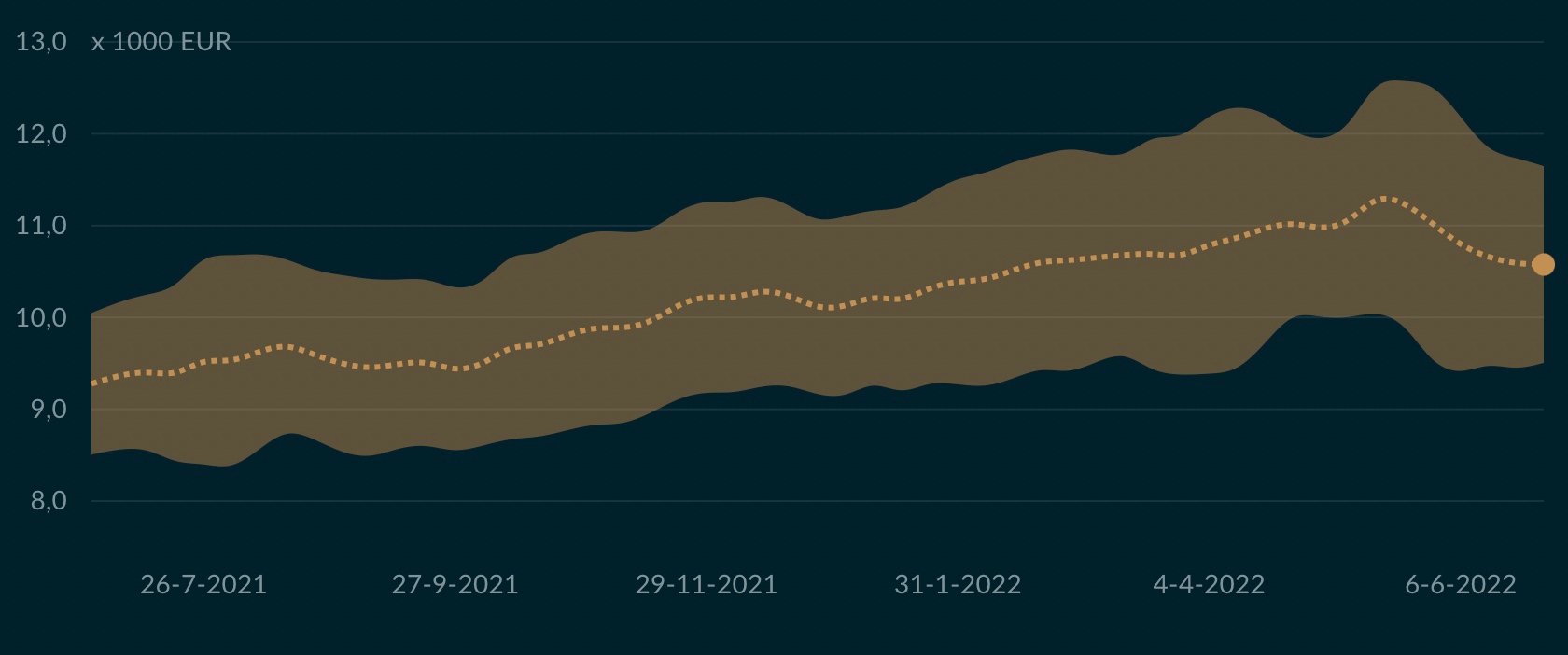

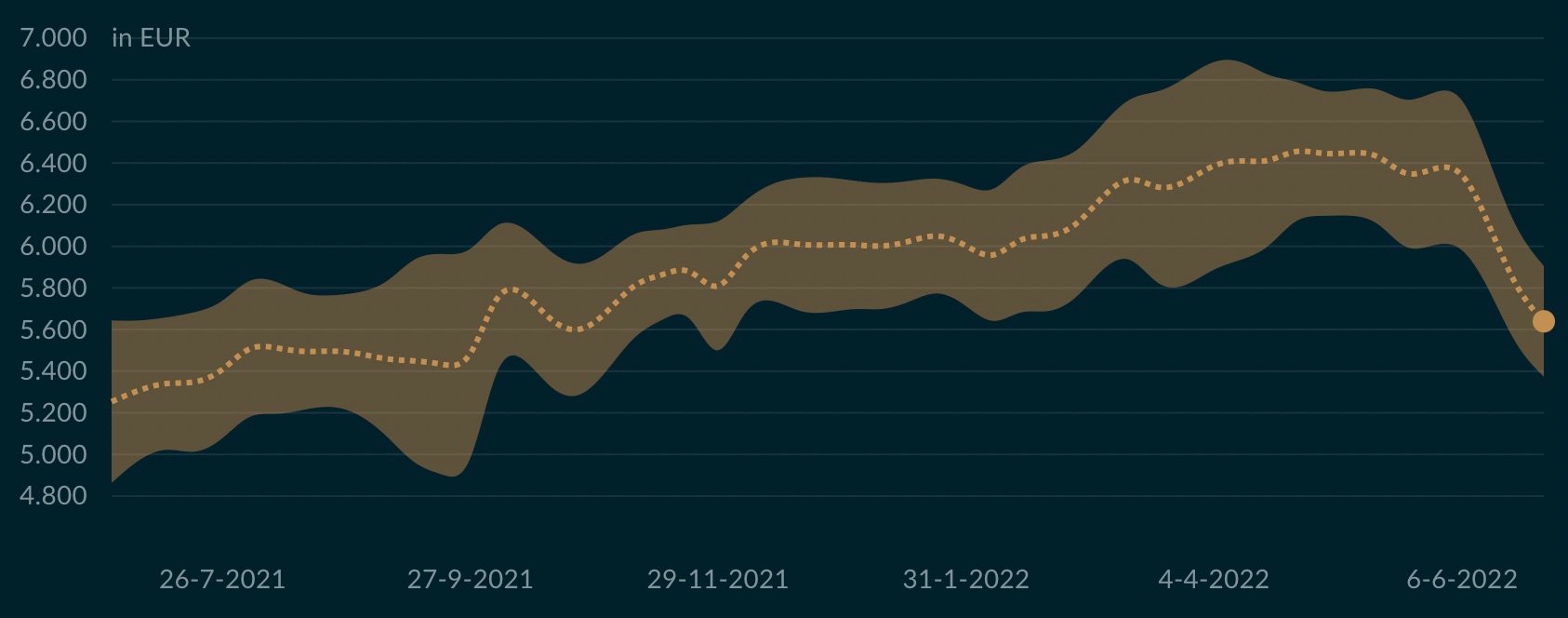

Let’s compare these to the previous, discontinued generation — the Submariner ref. 114060 and Datejust ref. 116200. These took a hit as well. They both saw a loss of about 4% between their peak and current prices. Comparing their current prices to July 2021, however, we still see massive growth. The Datejust went up approximately 20%. The Sub even grew about 24%. And yes, that includes the aforementioned slump.

- One-year price development of Submariner ref. 114060

- One-year price development of Datejust ref. 116200

This means that it was better this year — for your wallet, at least — to own a discontinued-gen Sub or DJ compared to a current-gen model. The growth was stronger and the correction was smaller.

- Submariner ref. 14060M

- Datejust ref. 16000

- Datejust ref. 16200

Five-digit reference Rolex prices

Five-digit Rolex references have seen a particular appreciation lately. Not quite vintage and certainly not modern, these “neo-vintage” models attract plenty of admirers. In the case of our Submariner and Datejust samples, they have recently come back down a bit.

The 14060M Submariner went down by 7%, which still puts it a generous 13% above its typical trading value 12 months ago. The refs. 16200 (sapphire) and earlier 16000 (acrylic) Datejust went down a serious 10% and 13% respectively. This still puts them 6% and 8% above last year’s value.

This makes sense though, as they have been reliably hitting growth around 7% for years on end. The question is, are they back on track now, or are we going to see further declines?

- Submariner ref. 5513

- Datejust ref. 1600

Four-digit reference Rolex prices

Speculators do not care as much for vintage, or so it seems. The average price of the Submariner ref. 5513 recently declined by only 3%. This puts its growth for the past year at a substantial 10%. You will see a much greater variance in the graph, which is due to the more homogenous nature of modern Subs. Vintage models come in more varieties, and condition comes into play more profoundly. This leads to wider price ranges.

The four-digit Datejust ref. 1600 performs similarly. A 4% correction puts it at +11% compared to a year ago. As with the five-digit references, these numbers are much closer to the typical yearly growth we have been seeing long-term.

Which is the smart buy?

I am no investor and certainly no investment advisor. And since you are here on Fratello rather than the Financial Times, I am assuming you are here for the love of watches too. It is, however, pleasant to know our money is not evaporating. For me, at least, watches are a substantial expense. It is comforting to know that some of them hold their value or actually gain a bit. I might not ever sell, but it is good to know that I could if I need to.

In that respect, in my eyes, the vintage stuff is a bit more transparent as a market. I get a sense — which is, admittedly, thinly backed by facts — that the growth here is caused by us. And by “us”, I mean aficionados and collectors like you and me. Seeing those four-digit references grow year over year by very similar percentages is reassuring. If a watch (Submariner ref. 124060) appreciates by 22% in just over a month, that does not seem healthy to me. It does not make me want to pull out my wallet and give it a go.

The last-gen models seem like a safer bet as well. They will likely suffer a dampened blow compared to current-gen models if Rolex manages to get stock into boutiques again. You are getting very similar watches at substantially lower prices. As it seems today, there is a little less risk involved.

Rolex prices going forward

It is hard to predict where Rolex prices will go next. Are we back on track for the “normal” year-over-year value development? Is the hype-fueled inflation corrected after the recent slump already? Or do we still have some ways to go? Do we need a little more of a correction before the market stabilizes?

In any case, the situation is frustrating. It has little to do with the love of watches. We can appreciate Rolex for its amazing products, but as collectors, we have not felt very welcome lately. One thing is for sure: the shortages will remain for a while to come. That means that prices will hit a support level at some point. However, anyone who claims to know when is lying.

What do you think? Where are Rolex prices headed, and which are the responsible buys in today’s market, in your eyes? Or are you fed up and no longer interested in The Crown altogether? Let us know in the comments.