The Rolex Daytona Is No Longer A Watch — It’s The Ultimate Get-Out-Of-Jail-Free Card

In the movie Leaving Las Vegas (1995), alcoholic Ben Sanderson, played by Nicolas Cage, pawns his Daytona for $500 to sustain his destructive addiction. Had he done so today, the cash he would get for his 1990s Rolex Daytona, Zenith-equipped reference 16520 would be closer to $30,000. Yes, the times, they are a-changing. The times have changed so much that the Rolex Daytona is no longer a watch. Because of waiting lists with no hope on the horizon and the steady rise into the stratosphere of prices on the parallel market, the iconic Cosmograph has become a symbol of many things — and many things that are not too positive, unfortunately. The Daytona is, in essence, a sporty chronograph of course, but in reality, it now functions as currency or a commodity. Where has the watch-fun element gone, and will it ever come back?

Do you want to play the blame game? If you have to blame one Rolex watch for nearly eternal waiting lists and abnormal prices on the secondary market, let it be the Daytona 116500LN. The shortage of steel sports watches from Rolex was already building up below the surface, but when the black- or white-dialed steel Daytona with a ceramic bezel debuted in 2016, it became crystal clear to everyone. The new Daytona was a clear upgrade and evolution of an already in-demand watch. And as soon as it hit Baselworld, people started talking about it, showing it online, and placing orders. Speculations about waiting lists started, the craze began growing, and it became some sort of vicious circle — a feeding frenzy, if you will.

The Rolex Daytona is no longer a watch — An outstanding reputation for dependability

Only if you have a long and strong relationship with your dealer and an extensive and excellent purchase history, your time on the waiting list — expect up to 36 months for steel Daytona — can be shorter. Don’t get your hopes up for an extra Rolex factory to churn out sufficient watches to cool down the market. That’s not going to happen any time soon. In other words, the shortage isn’t going away in the foreseeable future, and therefore, the prices on the secondary market won’t come down.

You could say that Rolex is suffering from the fact that it’s at the top of the food chain when it comes to the world’s most trusted brands. The reputation of the Crown is rock solid. Rolex is the watch equivalent of an AAA-rated bank. I bet many country’s central banks are even envious of Rolex’s reputation for dependability. In other words, your money is safe with Rolex. And because that is the case, the watch itself transcends its original functionality.

Rolex — the perfect tradable commodity in case of an emergency

A Rolex has always been more than a trustworthy travel companion. Because of the brand’s reputation, a Rolex watch has always been your get-out-of-jail-free card. It was American Travel Channel host Philippe Cousteau — yes, he’s the grandson of the legendary oceanic explorer Jacques Cousteau— who once said he got the advice from a British ex-Special Forces member to always travel with a steel Rolex. By the way, he also recommended not flaunting the watch, just like I once did, but rather to just have it with you.

That advice doesn’t stem from a Rolex’s excellent reliability, but mostly because it makes for a perfect tradable commodity in case of an emergency. That’s the bonus of having something on the wrist from one of the world’s most trusted brands. A Rolex is recognized as valuable and desirable even in the farthest corners of the planet. The Rolex is indeed some sort of get-out-of-jail-free card.

You can buy your way out of (almost) every situation with your Daytona. When you, for instance, look on Chrono24 for Daytona prices, you will see that they start around €20K. No idea what the Daytona-to-ngultrum exchange rate is — we’d have to ask someone from the Kingdom of Bhutan — but it will most certainly get you water, food, and a ride to your country’s embassy.

The Rolex Daytona is no longer a watch, it’s now solid collateral

You don’t even have to sell your Rolex Daytona to financially benefit from the watch. The luxury asset could be used to obtain collateral loans. And collateral loans are an easy and quick way to access cash with no credit check, credit history, or financial disclosures. You can get a loan of up to 75% of the current resale value of a Rolex Daytona; please do the math on your Daytona reference of choice by yourself. Due to Rolex’s solid reputation and its watches being in such high demand, it makes timepieces from the Swiss brand eligible for the highest loan-to-value (LTV) ratios available. The Daytona or any other Rolex on your wrist makes it possible to capitalize on its real-world value without the need to sell.

Money leaves bad patina

So, who are the people that buy Rolex Daytona chronographs on the parallel market for way above retail prices? People with money and who understand money. Bankers, for instance, I’ve learned from a respected reseller. And they don’t buy the Daytona to wear, enjoy, and admire, but to put into the safe. They’re speculating on a further increase in value. In my opinion, this does nothing good to the reputation of the watch, to put it mildly. The more people put the Daytona in the safe to gather value, the more bad financial patina it collects. Scratches and discoloration are personal patina, but money leaves bad stains on the Daytona’s reputation.

Rumors and word on the street

What also doesn’t help are stories and rumors about authorized dealers who are selling out the back door to pre-owned dealers for a quick and hefty profit. Or those that sell to select individuals who, after buying the new Daytona for €13,800, sell it to the AD’s “other” pre-owned store down the road for a nice profit. All this does is facilitate the dealer to sell it a second time for a much nicer profit. A new-in-box steel Daytona 116500 goes for €40,000-55,000 on the secondary market.

I’ve also heard of important/trusted/long-time customers being offered the watch of their choice — we’re talking steel sports watches from Rolex, but also sporty models from brands like Patek Philippe and Audemars Piguet — with a catch. And the catch is that they also have to buy undesirable watches in the brand’s collection to get the one they desire. If that doesn’t hurt the relationship with the customer, nothing will, if you ask me.

I know, it’s “just” rumors and word on the high street, but since the stories of practices like the ones I described are not incidental, it proves that money rules everything with an iron fist. The current market situation is all about short-term profit and has no eye on the long-term consequences. Greed doesn’t only hurt the retailer, it also hurts the value of the brand. That’s something Thierry Stern was well aware of when he decided to axe the steel Nautilus.

The waiting game

Can you keep a cool head? Do you have patience and stamina? If so, you can put your name on a waiting list for a Daytona. I can understand that even though there are interesting alternatives to the Daytona, they are not the real deal. And since the heart wants what the heart wants, you have no other option but to put yourself on a waiting list. Two things. First, don’t wait by the phone. Second, know you are on the waiting list with other committed, die-hard Daytona fans, but also with a lot of other people whose sole reason for having their name on that list is to make a quick buck. I do understand that one’s love for a watch can give way to the temptation to sell it for a profit. But that should only take place after wearing it for a while, not upfront. The latter has nothing to do with love; it’s financial speculation.

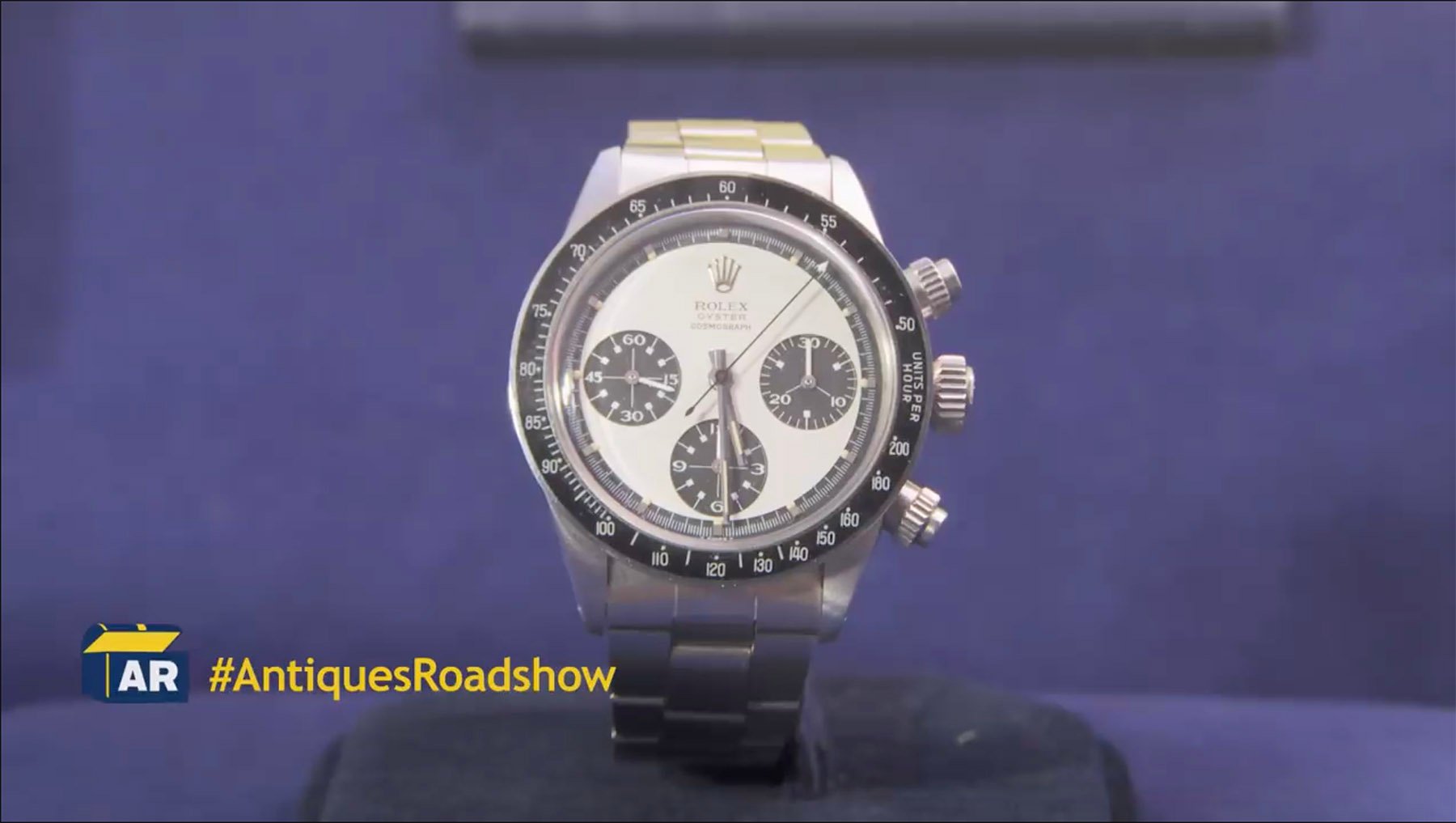

An ex-Air Force guy’s Rolex Daytona 6263

The problem with the Rolex Daytona is that most anecdotes about the watch revolve around money, like this one. An Air Force man buys a Daytona 6263 in 1975 while stationed in Thailand. He pays $345.97 for it. Over four decades later, he watches Antiques Roadshow on television, where people bring in kitsch, art, and other stuff like timepieces to have them appraised by experts. He recalls the watch he once bought that has been sitting in a safe-deposit box for ages.

The man gets his practically NOS watch appraised. He learns that a Daytona similar to his with a “Paul Newman” dial, a watch that was nearly impossible to sell all those years ago, is now roughly worth $150,000 to $200,000. But the ex-Air Force guy’s watch is a ref. 6263 with the much rarer screw-down pushers and “Oyster” on the dial. In production from only from 1970 to 1971, his particular watch is the rarest of the rare. And since his nearly NOS example has all the boxes and papers, its value could be as high as $700,000 today. That’s a “markup” of no less than 202,329%. Quite the (accidental) investment, I’d say.

The Rolex Daytona is no longer a watch — it’s all about the money

Yes, that’s a great anecdote, but is it really about the watch? I think it’s more about the money than the watch itself. And the same often goes for auction results. This is why the Rolex Daytona is no longer a watch. People don’t talk about the watch because watch fans can’t get their hands on them because of the shortage and the stellar prices on the secondary market. Things have changed even for owners who bought a Daytona fair and square, or pre-2016 when the world of watches was still spinning at a slower pace. That’s because of how other people now perceive the watch and what owners now know about its increase in value. It’s such a shame because the Rolex Daytona is an extraordinary chronograph with a fascinating history and a remarkable design.

If you want to know more about the Rolex Daytona as a watch and how many references there are nowadays, please check Rolex’s official website.

Please find and follow me at Lex Stolk • Instagram