The Vintage Market is Dead, Long Live the Vintage Market!

It’s been roughly a quarter since I wrote my last Vintage Market update, so it’s high time for another installment. Ever since publishing that article and committing to writing another, I’ve mulled over some potential topics. Clearly, a pure regurgitation of the fact that prices continue to climb – especially in the chronograph arena – would be a short article. So, I’ve decided to focus on some additive topics that certainly use that price rise as a backbone and I’ll attempt to dig a little deeper into some things that I’ve seen while alluding to what may come. If you’re in the northern hemisphere, there’s likely a foreboding Autumn chill in the air that signals the long winter ahead, but there probably also exists a warm hearth nearby within some cozy confines. That, readers, in a nutshell, is also how I see this fascinating vintage market…so grab a big coffee, settle in, and let’s get to it.

Chronographs – it’s good to be King

Since we last spoke, one thing has certainly not changed; the chronograph is still king. In fact, it’s king in a big way. Our friend Eric Wind even curated an interesting sale of the species over at Christie’s Watch Shop and social media is now flooded on a daily basis with people showing their latest acquisitions. Sure, there’s the always-active high end Patek (and other dressy brands) market and the Rolex dynamic, but the dress watch world is largely quiet and the dive watch market seems to show only moderate signs of life. Specifically, as it relates to the subterranean watches, there’s always Rolex, but we also see little pockets of activity around super compressors and early pieces from the likes of Longines, Omega and Blancpain. On the dress side, blame quietude on a world that generally dislikes wearing anything other than denim or the fact that most vintage formal watches were so small for the fact that they’re now a bit passé. Sure, there are exceptions in this market as some brands continue to sell well, such as the aforementioned high-end brands and even upstarts like Grand Seiko, but the dress market feels, to me, very much built for a clientele who buy pieces because they like them. There’s nothing wrong with that, but it doesn’t make for the most exciting copy. So, just like the last time, I’ll spend most of my time talking about the hot stuff: chronographs. This time, though, I won’t give any specific model recommendations, but I think you’ll be able to glean some opportunities from the topics of discussion.

Life Exists outside of Planet Rolex

We all know that vintage Rolex is expensive, damn expensive, when it comes to their sports watches. If we’re talking chronographs, we’re really talking about Daytonas and it’s become darn near impossible to source a decent manual wind model for less than $30K. Oh, and let’s also not forget that there’s a high degree of shadiness in this high profile market. Unlike some who think the best days are over for this brand, I disagree, but the high prices have absolutely caused collectors to look at other brands. And why not? There’s same amazing stuff out there. Chief amongst the beneficiaries of these wandering eyes are the Heuer chronographs. Their documented link to the glory days of motorsport, their unbeatable designs, relative rarity and solid mechanicals have all contributed to the brand’s rise with collectors. If Heuer is the flag-bearer in the rise of the “other brands”, they’re easily followed by so many other marques. If you have money to burn but just can’t get your head around spending so much on something like a Daytona, one can build a great, desirable collection of many pieces for the same amount of money.

A group of rotating bezels…3 of these pieces have the same movement, a Valjoux 72, and their looks are similar, but the market sees them all so differently…

Rarity vs. Desirability

From the heading of this section, you can probably guess where I’m going, but I still think it’s worth a few paragraphs. When any hobby increases in popularity like what has occurred with vintage watches, feelings and emotions are bound to come into play. Over the past several months, I’ve read more posts from people either trying to trump up their watches because the market hasn’t noticed them or they’re trying to put down another’s watch for being more expensive than it “should be”. Well, this, folks, is called the market. Sure, market manipulations occur, shilling happens and cornering is potentially possible, but at the end of the day, the market always wins. How long that “day” lasts is a fair question, but the market always wins (I’m a long-term subscriber to the “Invisible Hand”) in the end. Let me go a little deeper.

If you follow the vintage market with any level of tenacity, you’ll know that a very rare Heuer 1st execution 2446 Autavia recently sold on eBay for roughly $45k. Half of the market watched with anticipation and interest while another group decided to go on a rampage decrying the watch as a worn out pile of garbage. In case you’re unsure, I was in the former group. 😉 The latter group seemed to be full of grumps, who were disappointed that the watch wasn’t theirs, or upset that their watches weren’t receiving such attention. Well, guess what, the market spoke and it decided that this watch was/is significant because it is a) rare, b) an original sports chronograph and c) the first edition of a highly desirable line of watches. This watch had rarity and desirability on its side, but markets are funny because rarity isn’t always necessary to drive demand.

I’ll bring in some comparisons to the art market when I discuss rarity and desirability because I think it makes some sense. Let’s briefly take two of the most well known modern artists from recent history: Andy Warhol and Pablo Picasso. I won’t talk value but I am sure you’re well aware that these artists were highly prolific. Heck, Warhol worked in “the factory” and made lithographs! Picasso, once he had reached a level of fame, started, as my Dad likes to say, “pumping stuff out” in ridiculous quantities. Guess what? I don’t think you’d consider either artist’s work to be particularly rare, but most of their work is extremely desirable. Some subtleties there…not everything from them is rare and most is desirable. There are some works done by these artists that are interesting or important and maybe even more rare than other works or periods, but they’re nowhere near as desirable as some more common pieces. Seriously, how many soup can pieces are out there!?!? Vintage watches are no different. Yes, the world is comparatively awash in vintage Rolex Daytonas versus Zodiac Triple Date Chronographs, but, relatively speaking, no one cares about the Zodiac – at least right now. The market desires Daytonas. Finally, do you see what I did there? I said “right now” and that’s important because markets and tastes do change. So, cranky curmudgeons, your Clebars may still yet have their day in the sun!

In the “rise of the movements”, pieces like this Wyler, with its Valjoux 72, are receiving more attention

Transformation: the rise of the Movements

Another transformation I’ve noticed over the last quarter is the “rise of the movement”. Long-term collectors and hobbyists won’t see this as anything new, but the words “column wheel”, “Valjoux 72” and others are now in the vernacular of a lot more people than ever before. Go look on eBay for a given watch and you’ll often see movement names as typical suggestions for your next search. Crazy! Over the past quarter, as the fervor grew and people started to search for value, they began to realize – hopefully in part from reading sites like ours – that parts and supply base sharing occurred en masse back in the 1960’s and 1970’s. Brands that are now long gone often used the same movement and dial suppliers as the “big boys” that are still with us today. Good examples of this are brands like Croton, Wakmann, and on and on. Sure, it’s had the effect of pushing up prices of watches that formerly cost next to nothing, or worse, were often harvested for their parts and then discarded. Still, though, these pieces are relatively affordable and it’s allowed a lot of people to get into the hobby. Plus, and I don’t mean to preach like Dr. Phil, it is a nice, satisfying feeling when you’re wearing a $1,500 watch – say, a Croton V72 – that actually shares a lot more in common with a $150,000 Paul Newman than one would think. I actually feel that the fact that build quality, movements, dial fonts, hands, etc. were so similar across so many brands in the 1960’s is one of the most significant contributors to the growth of this hobby: credible, attractive, and affordable pieces really add to the fun.

These are still early days…

If we consider what’s happening in the vintage chronograph market, there are a lot of watches that have gone unnoticed until only recently. The cool thing is that there are probably more neat pieces to “uncover”. When a newly uncovered piece takes center stage, there’s usually a run-up in pricing and then things subside a bit or, perhaps, they just continue to creep up at a lower level. Add to this the other phenomenon of people continuing to uncover celebrities and motorsports personalities wearing vintage chronographs. The next find is always around the corner…

The other sign that things are still early is that the market is still undergoing “segmentation”. If you work at a big company, you’ve probably heard this buzzword. Essentially, it’s exactly like the word means…you break something into pieces or segments to help determine a strategy. In the vintage chronograph market, we seem to have the blue chip pieces segment: the Daytonas, the Speedmasters, the UG’s, various Heuers, some Breitlings and a couple Zeniths – and perhaps some Enicars. I’m missing some in there, but you get my point. In the next segment, we have things like Gallet, Wittnauer, etc. On the lower rung, you can pretty much throw everything else in. For sure, some brands have models that “punch above their weight class” and drift into other segments and vice versa, but I see the above as the relative current state. That’s the funny thing, though, because collectors are still determining this order. As an example, let’s be honest, very few gave a hoot about Enicar before a year or so ago aside from the hardcore collectors who had experienced the quality firsthand. I don’t see the rise of Enicar being typical, but who knows? So, to me, it shows that the market really isn’t mature yet. As more and more information gets published, and more transactions occur, I expect this segmentation to settle.

Where are we going?

The future of the vintage chronograph market, and vintage market in general, is a favorite topic on a lot of forums. Many longtime collectors fear that the end is nigh because pricing has escalated so quickly and dramatically…things must be overheated. The “tulip mania” is often brought to light on forums (it’s always fun to pick on something Dutch with my Fratelli teammates 😉 ) as an historic example. Others feel that it’s simply high time that vintage watches get their due and we are really only in the beginning of something sustainable. I suppose I fall somewhere in the middle but slightly more on the side of sustainability. That being said, rather than trying to convince you of my general feeling, I’ll present what I see as the potential boons to the market and some probable banes.

Nothin’ gonna break my stride or Bulls on Parade!

Ok, as promised, here are my arguments, in no order of priority that we’re in for a continued rise in demand, interest, and pricing for vintage chronographs.

- The bulk of vintage chronographs are still “cheap”. A couple points here. First, and this absolutely relates to my point above about Rolex, if we do use the fact that a lot of parts were shared amongst companies, the seemingly high cost of, say a $10K+ Heuer Autavia “Rindt”, still seems downright cheap compared to a similar Daytona. So, I call it the “vintage Rolex is too expensive, what can I buy instead” theory. This theory, when using the Daytona as the benchmark, supports higher pricing for a lot of other watches, by the way. Second, despite the big increase in vintage chronograph pricing, a lot of these prices are still comparatively cheap when compared to new watches. That’s right, you may hem and haw over whether or not a correct, hard to find, column-wheel equipped, vintage chronograph in excellent shape is too dear at $2500, but go and compare that to a nice, new watch. Today, amongst new offerings, what’s considered as an “also ran” chronograph likely features a me-too movement, is all too easy to source, suffers in resale value and still likely costs $3000 or more. I’d actually say that the argument becomes even more compelling in the $5-10K arena. Sure, new watches have a warranty and can go in in the swimming pool, but you wouldn’t be looking at vintage if these were your real concerns, would you?

Wearing a vintage watch gives me a lot of satisfaction…I can look down upon it at any point during the day

- As an investment for a man, I contend that, other than perhaps equities, coins or bullion, there’s not much out there that’s as portable as a watch. A nicely sized collection is easily moved and you can’t say that about either art or cars. More importantly, watches are highly satisfying. Why? The wearer can look at a timepiece all day. Perhaps if I had a massive office on Madison Avenue that I could outfit with a modern art collection, I’d feel the same way about collecting paintings, but I don’t. No, I travel and I go to my place of work and one thing stays constant, a watch comes with me. I like that I can actually use and enjoy my investment. Of course, I think you’d be a fool to invest only in watches, but rounding out one’s portfolio normally makes good sense…and why not enjoy your assumdely hard-earned money?

- There’s still more to discover. I mentioned it above, but it’s worth repeating. I hear stories all the time – we will share more soon – of people unearthing old photos of racecar drivers wearing vintage chronographs. This always drives more interest. Furthermore, pictures of beautiful models that were only found on small forums are starting to pop up on widely read places like Instagram and this drives even more interest.

- There is finite supply but it hasn’t been tapped yet. Think of basements and attics as untapped oil fields and you get my point. My guess is that we have another 20 or so years of unearthing via “estate finds” if we’re talking solely about 60’s chronographs. It’s a bit macabre, but as people go through their junk – for whatever cause – more watches will be found and placed on the market. To me, that’s exciting, makes for great stories, and will draw interest.

- Economies recover. Yes, there’s worry out there about the economy, but I have to say, I haven’t really felt comfortable since the events of 2008-2009 and this hasn’t seemed to hurt the market for vintage chronographs. I can’t predict the future of various economies, but we are in a global setting now as far as news. Watches get shipped all over the world, so if Japan’s market is in the toilet, perhaps the USA is picking up the slack. It’s tough to say, but right now, the demand seems universal.

- Counterfeits are a “one-brand” problem. Outside of Rolex, fakes seem to be rare in the vintage chronograph world. Sure, “Frankens” exist and pieces come up that are just plain wrong, but I just don’t see a cottage industry sprouting up to create fake Wyler chronograph dials. Maybe I’m underestimating 3D printing technology or something, but I just think the offerings are too varied to create a good market for fakes.

- Resources for good information are out there and easy to access. A market needs good, solid information in order to flourish. While we will likely never see production numbers for most vintage chronographs, or know the details of every transaction, collectors can speak with knowledgeable people in the hobby before putting down good money on a watch. Plus, with the power of the internet, it’s easy to do some research on one’s own.

Breitling Top Time 810’s sat unnoticed for a long time…people have finally realized that there’s a lot to like.

- Coverage is growing. Call it hype or call it information, but credible coverage on the hobby has increased and I’d like to think that’s supportive of demand.

- The vintage market is not tied to the new watch market. Robert-Jan can provide all kinds of information on the new watch market, but there’s clearly an issue out there today with too much inventory and some concerning demand trends out of places like China and Russia. I’d contend, especially if we use the two countries I just named as an example, that the vintage market is unaffected. The demand for vintage watches in these places is relatively nil compared to other markets. Likewise, the vintage market doesn’t seem to be impacted by the burgeoning trend of smart watches. So, so far, the vintage market feels somewhat impenetrable to these macro factors.

The Seiko world has quietly inched up along with a lot of other watches. I’ve started to notice them for sale (and selling) in European and American auctions…

- The massive interest in homemade/housemade/sustainable/local goods/organic/recycling/hipster stuff/beards/flannel/straight razor barbers/old crap is good for vintage watches. Hehehehe… Sorry, I didn’t really know how to say it, but despite our love of material things (vintage watches falling into that category), we as a people are starting to feel guilty about what we’re doing to our planet. Whether we do anything about it remains to be seen, but we’re becoming more aware of how far we drive for things, where our stuff comes from, energy use, supporting our local towns, investing in local handcrafted items, etc. Vintage watches somehow fit this trend because they were typically handmade, have character, can be fitted with local, handmade things like straps, are recycled (that’s a stretch) and are a good way to exhibit one’s own unique style. Provided that we don’t start dressing like the Jetsons or go back to the poofed out styles of the 80’s this trend could be here to stay for a long while. Oh, and as an aside, while I don’t have a beard (too itchy and my wife would kick me out), I do recycle while wearing flannel in my Red Wing boots. 😉

For under $800, pieces like this Vulcain with its column wheel movement, can still be found with a bit of patience…

Pigs get fat, hogs get slaughtered or the Bear Trap

Now, I get to be Scrooge McDuck or Mr. Freeze and throw cold water on the party, invite ants to the picnic, yadda, yadda, yadda. Let’s talk about some icebergs that could lie in the way of the Titanic…and I’m out of clichés.

- Economic decline. As much as I think there are opportunities for one geographical market to step in for another in the event of a local decline, there also exists the possibility that a global slowdown could occur. There’s no doubt that the behemoth called China directly or indirectly affects a lot of the world today and if it derails completely, I’d expect people to hesitate before flippantly blowing thousands on an old watch. In a market, hesitation usually leads to stagnation, which leads to decline. By the way, China was just an example…any number of things can always go wrong! 😉

- Lack of supply. Ok, I lied about prioritizing my bullet points because an economic meltdown and a lack of supply are my two greatest concerns. Right now, good, even just decent, vintage chronographs are snapped up almost immediately. I talk to vintage sellers and they all cite a real problem in getting good blue chip pieces. They’re even having trouble finding next tier pieces right now. People, and I am guilty, are hoarding watches. I don’t do it in the hope that I’ll come away wealthier in 5 years. No, I do it because I like owning them and there are a lot of people like me. We are bad!! Want an example of lack of supply? Six months ago, it was a cakewalk to find a burgundy bezel Wittnauer chronograph. Today, I see one for sale at a silly price and it’s been there for a loooong time. Lack of supply can ultimately lead to disinterest and frustration. Hey, I get mad when I can’t find what I want (note: I call @watchfred for therapy…but he’s really expensive because he points me towards other watches). Sure, for absolutely key pieces, lack of supply is normal, but there’s a real paucity of good mid-grade stuff right now and that is a true concern. Ultimately, people will get tired of just looking at pictures…especially if they have money in hand.

- People lose interest in vintage watches. I don’t know what would cause a change of interest, but perhaps people will go whole hog into smart watches and just abandon wristwatches altogether. Or, maybe people will collect those ugly Lladro statues instead! That’s a joke, but interests do change and people do get older or grow out of an interest. I think the hobby has to continue to attract new entrants, especially from the younger generations. So far, it’s doing well with this, but if the pool of collectors begins to shrink due to waning or changing interests, watch out!

“Ugly ducklings” like this Breitling Top Time ref. 814 are getting more notice…they’re still cheap and the quality is fantastic

- Prices get too high. At some point, high or ludicrous pricing would limit the number of collectors in the market and they may just decide to sell everything or get turned off entirely. Thankfully, today, a lot of pieces are still negotiated in good faith or are auctioned with no reserve. If sellers hold out for too long with high pricing, I could envision a crash.

- Auction houses selling some bad stuff. Auction houses do a lot of good things and I find them to serve as an excellent market barometer, but I’ve watched some auctions recently and there has been some regrettable activity. I’ve seen watches wrongly described, watches described using the painful “all original” or “mint condition” when those descriptors are plain wrong, and I’ve seen fake or recased items. In my opinion, this type of thing has to stop. While I get it that buyers should do their own due diligence, I really do think that if you’re going to pay high commissions, it’s not unreasonable to expect the auction house to have more skin in the game.

- Some of the people. Well, I’ve said it before, but any time you take a hobby with this much growth, it’s bound to attract undesirables and plastic people. On the undesirable side, these are the shill sellers, the fakers, and the people who are out to rip you off. Of course, you’re not going to get ripped off because you’re going to ask for advice first, correct? Good…issue sorted. Then, you have the plastic people. Well, they turn me off, but perhaps I just need to ignore them. I find there’s a real difference between posting on Instagram and showing enthusiasm about your latest pickup versus showing off in hopes of impressing others. Additionally, I can’t help but feel a bit sick to my stomach when I see someone posting a gorgeous Universal Geneve or Daytona in pair with their atrocious Louis Vuitton belt, Hermes man-purse, white Gucci loafers and popped collar Lacoste. You know the type – we should lock them all in a room so they can admire each other. So, yes, seeing too much of this could lead me, and presumably others, to believe that this wonderful hobby is filled with hordes of shallow lamebrains. ‘nuff said…

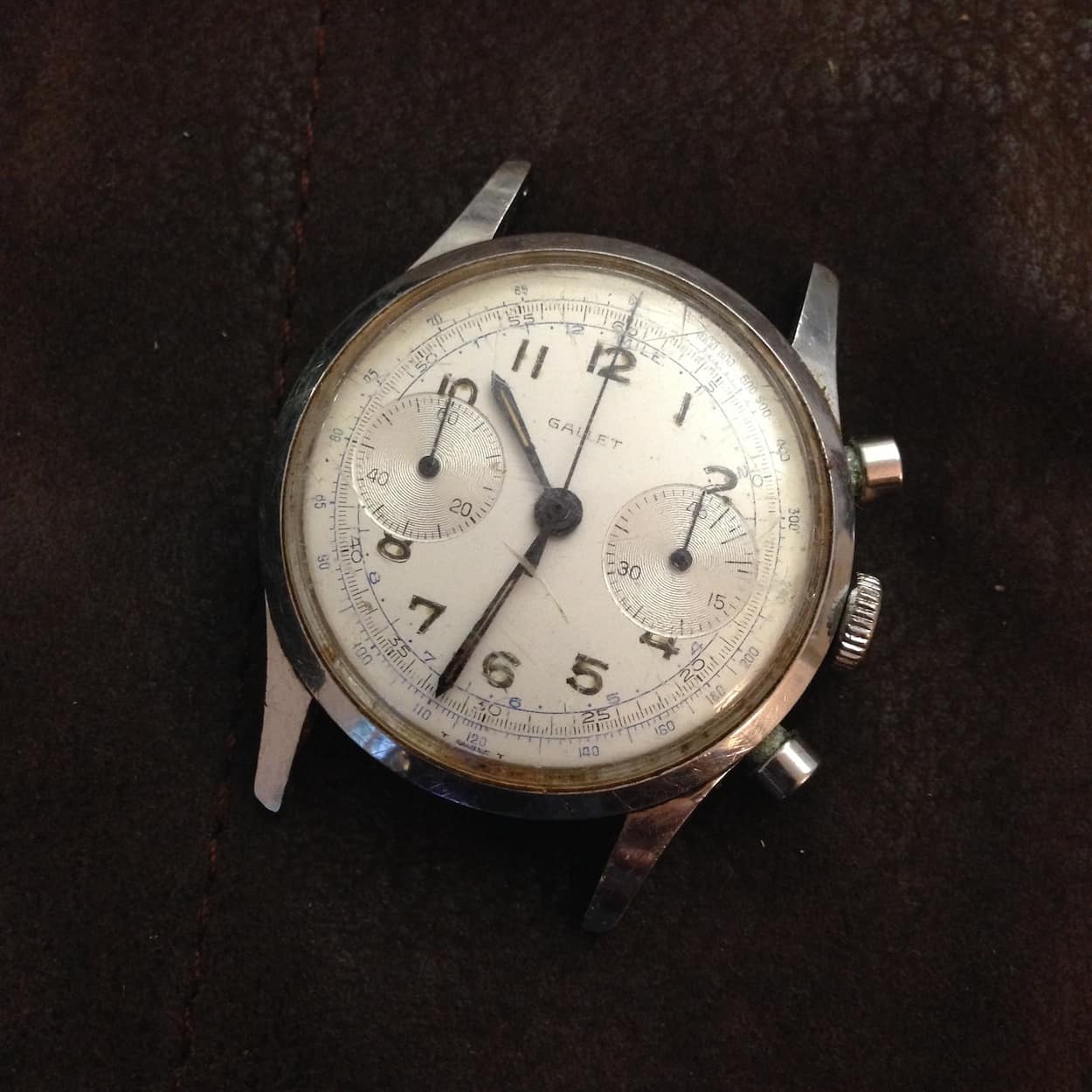

My love affair with triple register, column wheel movements took me down the path of buying this relatively raw, unrestored Gallet Multichron EP40

There you have it…a lengthy look at some of the things I’ve seen over the past quarter. I guess I took some cloaked shots at people and maybe that’s a little unfair, but, hey, it’s an editorial. Plus, this article was meant to be a bit provocative, so let’s get it on…what do YOU think about the vintage market? Let the debate begin below!