Trump’s New Tariffs Rock The Swiss Watch Industry

While my colleagues and most of the industry have been in Geneva, enjoying Watches and Wonders and devouring the sights and sounds of the year’s biggest trade fair, I have been watching on from home this year. I welcomed my firstborn son into the world and moved house less than two weeks later (apparently, I am a glutton for punishment, but I digress). As a result, I’ve had time to digest broader world news as I’ve not been rushing from meeting to meeting all day. One such story that has dominated the news has been the introduction of Trump’s new tariffs on global exports to the US. The initial response to these has been… negative, to say the least.

It all began with a financial thunderclap: stock markets worldwide plunged in the wake of President Donald Trump’s tariff announcement. The US S&P 500 index nosedived nearly 5% in a single day, wiping out roughly $2 trillion in companies’ market values worldwide. European luxury stocks followed suit, sliding sharply as investors grappled with the news. It was the worst day on Wall Street since 2020, and the reverberations were felt from New York to Tokyo (as well as here in rainy Manchester). This dramatic market reaction underscores just how significant Trump’s new trade measures are, not only for big tech and autos but also for one of Switzerland’s proudest export industries, luxury watches.

Happy Liberation Day, folks!

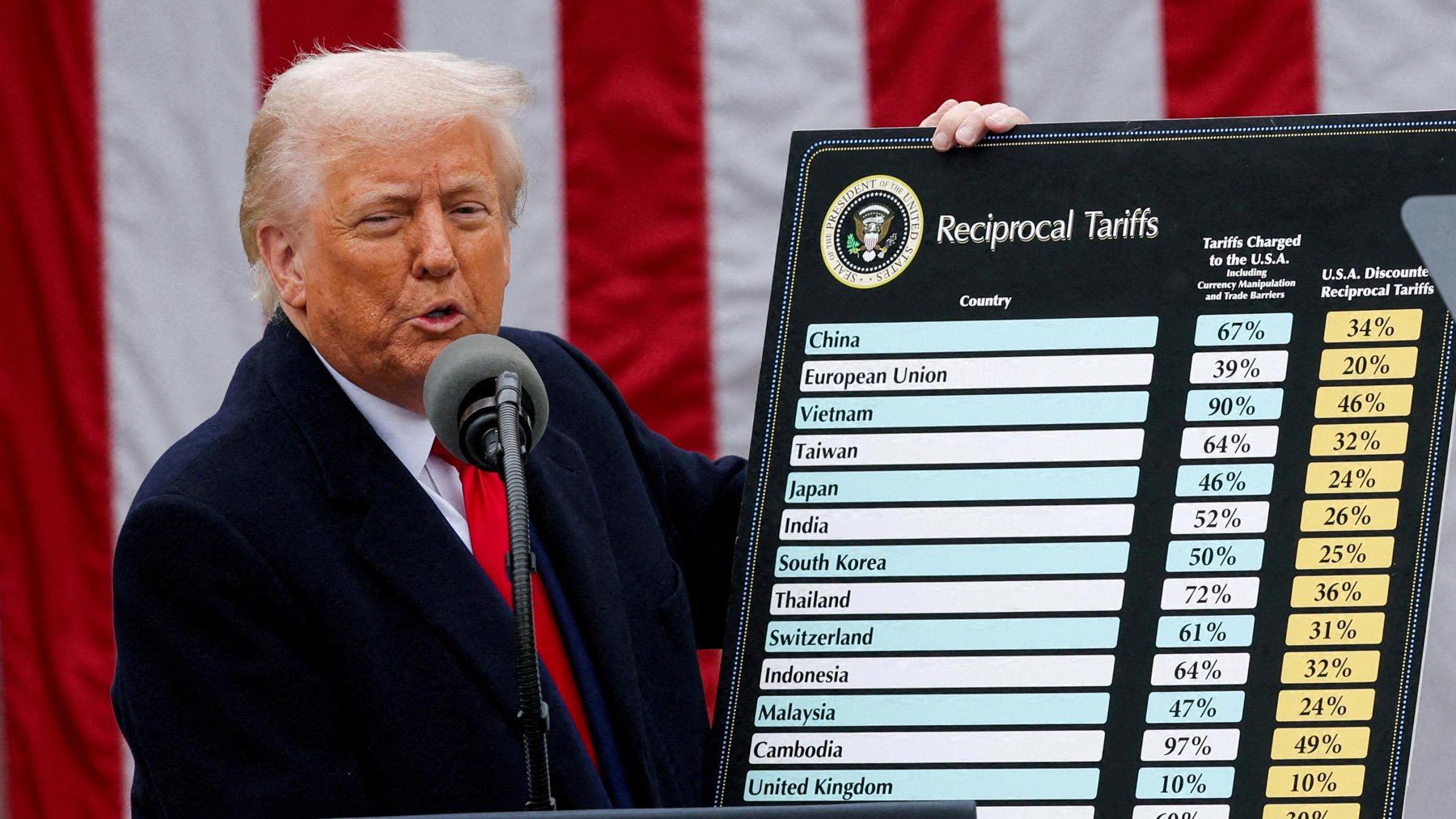

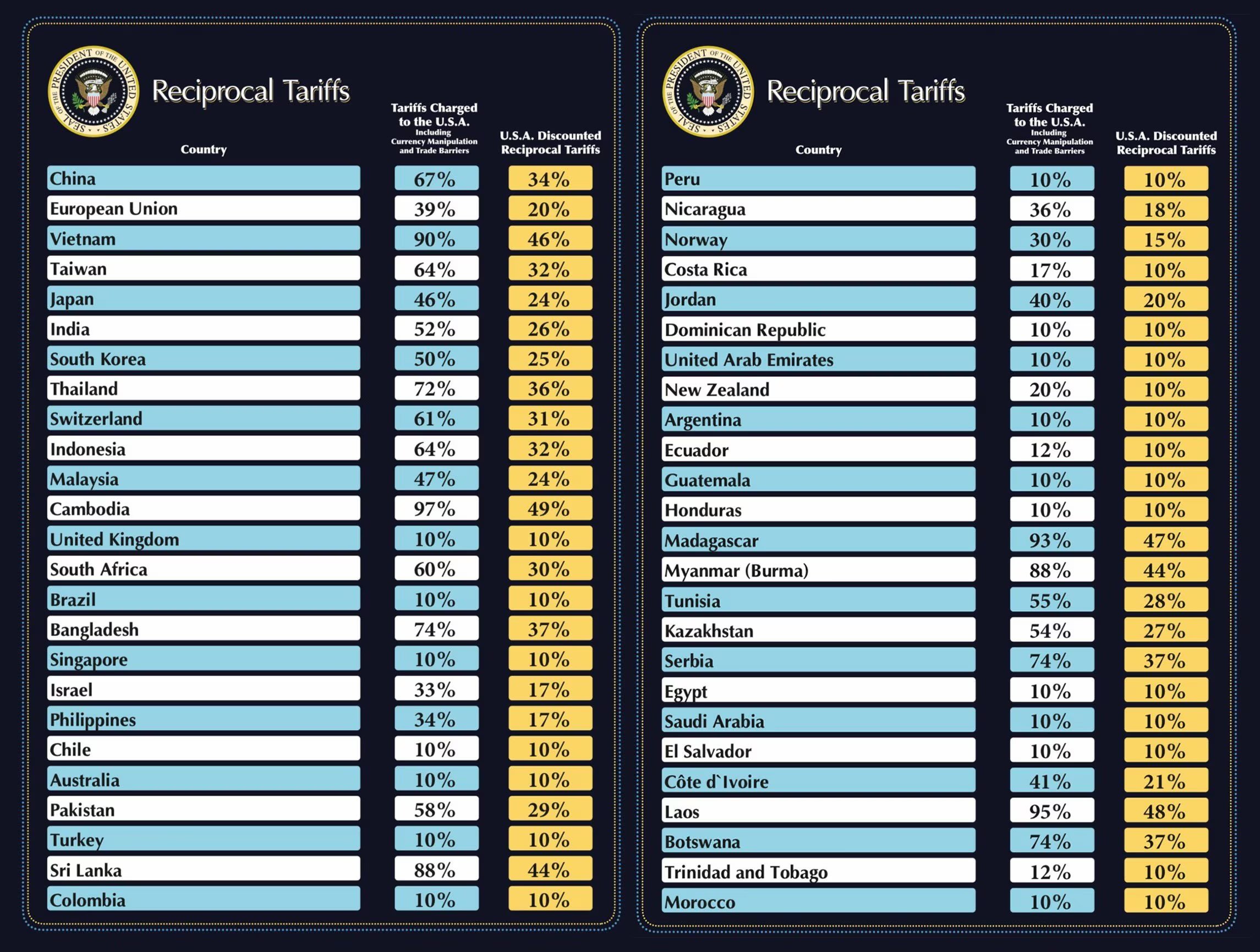

At the heart of the turmoil is the sweeping set of import tariffs unveiled in what Trump dubbed his “Liberation Day” trade policy speech. The plan imposes a 10% blanket tariff on all US trading partners, with steeper “reciprocal” surcharges for specific countries. Switzerland drew a hefty 31% tariff on its goods bound for America, the highest rate among US allies. By comparison, the European Union faces a 20% rate, the UK 10%, and China a whopping 34%. News of these unprecedented tariffs — the highest US import duties in nearly a century — immediately spooked investors who feared a global trade war and higher consumer prices. Amid the chaos, Swiss watchmakers suddenly found themselves caught in the middle of international trade politics.

Swiss watches caught in the crossfire

For Switzerland’s storied watch industry, the United States is vital. America recently became the number-one market for Swiss watches, accounting for about 16.8% of Swiss watch exports (approximately 4.4 billion francs’ worth). To put that in perspective, nearly one of every six francs the industry earns from exports comes from American collectors and consumers. This tariff bombshell thus lands squarely on Swiss horology’s doorstep.

From our understanding, in the case of Swiss watch brands shipping their wares to the US for further distribution, the tariffs apply to watches’ export prices (not the retail or wholesale prices). However, if you buy a watch directly from a Swiss dealer, the 31% tariff applies to the selling price (excluding Swiss VAT). In the latter case, a watch will cost almost one-third more when it reaches an American buyer. For example, a watch priced at CHF 20,000 (around $23,000) would now rack up roughly CHF 6,000 in extra import duties. In both cases, Swiss watches become a significantly more expensive indulgence for American collectors than they were last week.

Of course, Swiss watch sellers and distributors are alarmed. Deals are now in limbo as US clients understandably balk at the sudden price hikes. If retailers decide to raise sticker prices to cover the tariff, they risk choking off demand. However, if they try to absorb the cost, already thin profit margins will be stretched to breaking point. This squeeze is expected to hit entry-level and mid-range Swiss watches the hardest since buyers at those tiers tend to be more price-sensitive, and brands have less cushion in their margins. Even at the high end, the math is daunting. In short, whether you’re a boutique independent or a big-name Maison, selling Swiss watches to Americans just became a far more complicated equation.

Putting on the week-long-party brakes

Compounding the industry’s jitters is the timing of the announcement. The news broke right in the middle of Watches and Wonders. What should have been a week of champagne toasts and optimistic deal-making quickly turned somber. Behind the lack of natural daylight, brightly lit booths, and newly hyped watches, executives were fretting about the future.

Many had hoped the watch sector might dodge the tariff bullet — after all, unlike cars or electronics, there is virtually no mechanical watch manufacturing on US soil. In other words, imposing a heavy tax on Swiss watches won’t magically boost the American watch industry; it simply makes the real-deal Swiss articles more expensive for Americans. That reality left Swiss insiders perplexed and concerned. Meetings with US partners were reportedly canceled at the show, and an uneasy tension hung over discussions. It’s a bitter twist: on the week Switzerland celebrates its watchmaking heritage on the global stage, a trade policy move from Washington casts a long shadow over the festivities.

A critical market is now at risk

Why does this tariff sting so much? The Swiss watch industry has been leaning ever more on American demand in recent years. After the pandemic shock, US sales rebounded strongly and grew about 5% in 2024, helping prop up Swiss export figures. By contrast, the once-booming Chinese market has faltered. Swiss watch shipments to China plunged by over 25% last year amid economic struggles. In effect, US consumers have been picking up the slack left by a cooling Asian market. Swiss watchmakers, from luxury brands like Rolex, Patek Philippe, and Vacheron Constantin down to volume brands like Longines and Tissot, have all benefited from Americans’ continued appetite for Swiss timepieces. Now, with a 31% tariff threatening to dampen US demand, that crucial lifeline is in jeopardy.

It’s far bigger than just fewer millions in the big brands’ coffers

The broader implications stretch beyond just lost sales this quarter. If US consumers cut back on buying new Swiss watches (or American retailers curtail orders due to higher costs), Swiss manufacturers could see inventories pile up and cash flow tighten. Smaller suppliers and component makers — the ecosystem of part makers that feed the big brands — are already anxious as some US clients put projects on pause.

There’s also the threat of retaliatory moves or a prolonged trade war. Switzerland’s government has voiced its commitment to free trade and hinted at pursuing talks or legal remedies, but any resolution could take time. In the meantime, Swiss watch firms must decide how to respond. Some may hold off on planned investments or expansion. Others might quietly adjust their pricing strategy, perhaps introducing price increases globally to spread out the impact or prioritizing other markets if the American segment slows dramatically. The risk is that a tariff-driven slump in one of their top markets could knock the industry’s post-pandemic recovery off course just as it was starting to stabilize.

Where there’s a will, there’s usually a way

It’s worth noting that buyers of luxury watches are a passionate bunch; die-hard collectors won’t simply abandon the hobby because of tariffs. We might see more creative workarounds, like increased buying of pre-owned watches already in the US or travelers picking up watches abroad to bring home (within legal limits, of course). However, such adjustments take time and don’t fully offset the hit to new watch sales.

More worrisome is the psychological effect: trade tensions and market volatility can sap consumer confidence. If global economic growth slows due to an escalating tariff battle, the fallout will hurt all luxury sectors, including Swiss watches. The US market is critical for Swiss watchmakers’ health, especially with China’s outlook uncertain. The nervous mood in Geneva reflects a realization that this issue goes beyond a temporary blip — it challenges the industry’s game plan for the foreseeable future.

Navigating uncertain times

So, where does the Swiss watch industry go from here? In the short term, all eyes are on diplomatic efforts and any signs that these tariffs could be rolled back or negotiated down. History shows that broad tariffs can be a double-edged sword, often hurting industries and consumers on both sides of the border. Swiss officials and industry groups will likely lobby hard for exemptions or a quick resolution, emphasizing that the luxury watch trade has long benefited both the Swiss economy and American retailers and collectors. In the meantime, Swiss brands will have to adapt.

We may see brands delaying shipments to the US until there’s clarity or fast-tracking some deliveries before the tariff officially takes effect on April 9th. Pricing strategies will be reassessed; some companies might temporarily absorb some of the costs to keep their US partners happy, while others could accept lower volumes in exchange for preserving margins. None of the choices are easy, and each comes with risks.

Final thoughts on Trump’s tariffs and their potential effects

What’s clear is that the Swiss watch industry is entering a challenging chapter that few saw coming. Just when global supply chains had recovered from the pandemic and demand was rebounding, geopolitics threw another curveball. However, if there’s any silver lining, it’s the resilience this industry has shown time and again. Swiss watchmaking has survived world wars, disruptions from quartz technology, a pandemic, and financial crises. Tariffs, while painful, are another hurdle to overcome through ingenuity and patience. As the situation unfolds, expect the conversation in Swiss boardrooms and workshops to revolve around staying agile and keeping enthusiasts engaged, tariff or no tariff. After all, the allure of a finely crafted Swiss timepiece isn’t easily dimmed by politics.

Now, particularly for our Fratelli in the US, where do you stand on the topic? Are Trump’s tariffs a temporary tempest or a long-term game-changer for the watch world? How do you think the Swiss industry should respond? Please share your thoughts in the comments below, and let’s discuss!