Watch Auctions And Temptation: A Cautionary Tale

As hunter-gatherers by nature, we humans have always liked collecting. And when it comes to collecting, one attribute has always stood out as desirable — rarity. When something is rare, it’s exclusive by definition. Not many can possess a rare item. This rarity and desirability make such items valuable. Unfortunately, since greed is also a human trait as old as time, this is where it starts getting complicated.

Watch auctions and temptation

Auctions offer quite the experience — exclusivity, thrill, speculation, profitability, and risk. Profitability is an interesting one. It’s a side effect, or it used to be (and a very tempting one at that). Every speculative investment comes with a risk attached to it. Professional investors look at a risk-reward ratio. Now, what if you could engineer the profitability of an investment with a favorable risk-reward ratio? That leads to temptation. Suddenly, what used to be an unreliable side effect becomes the center of attention.

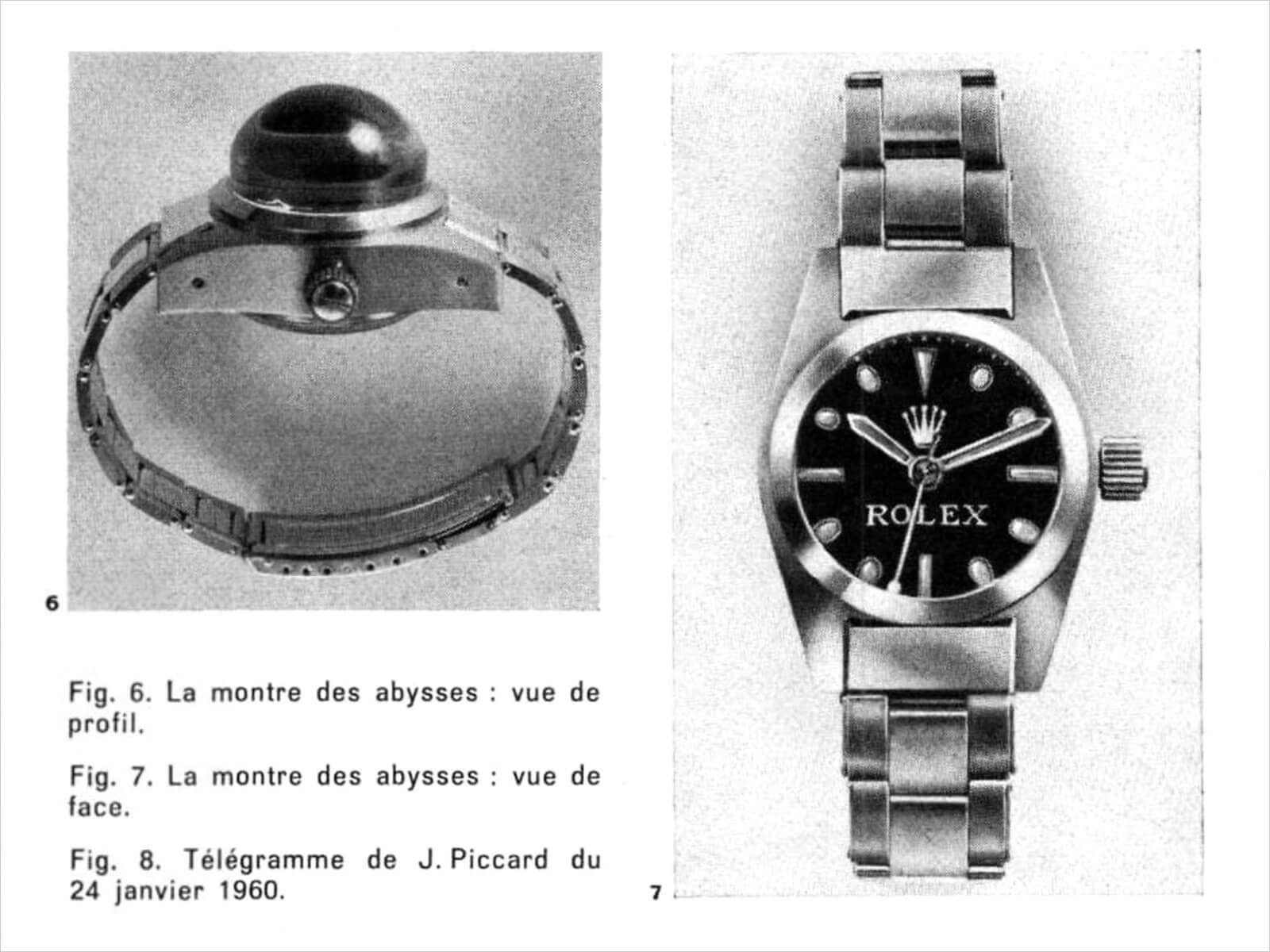

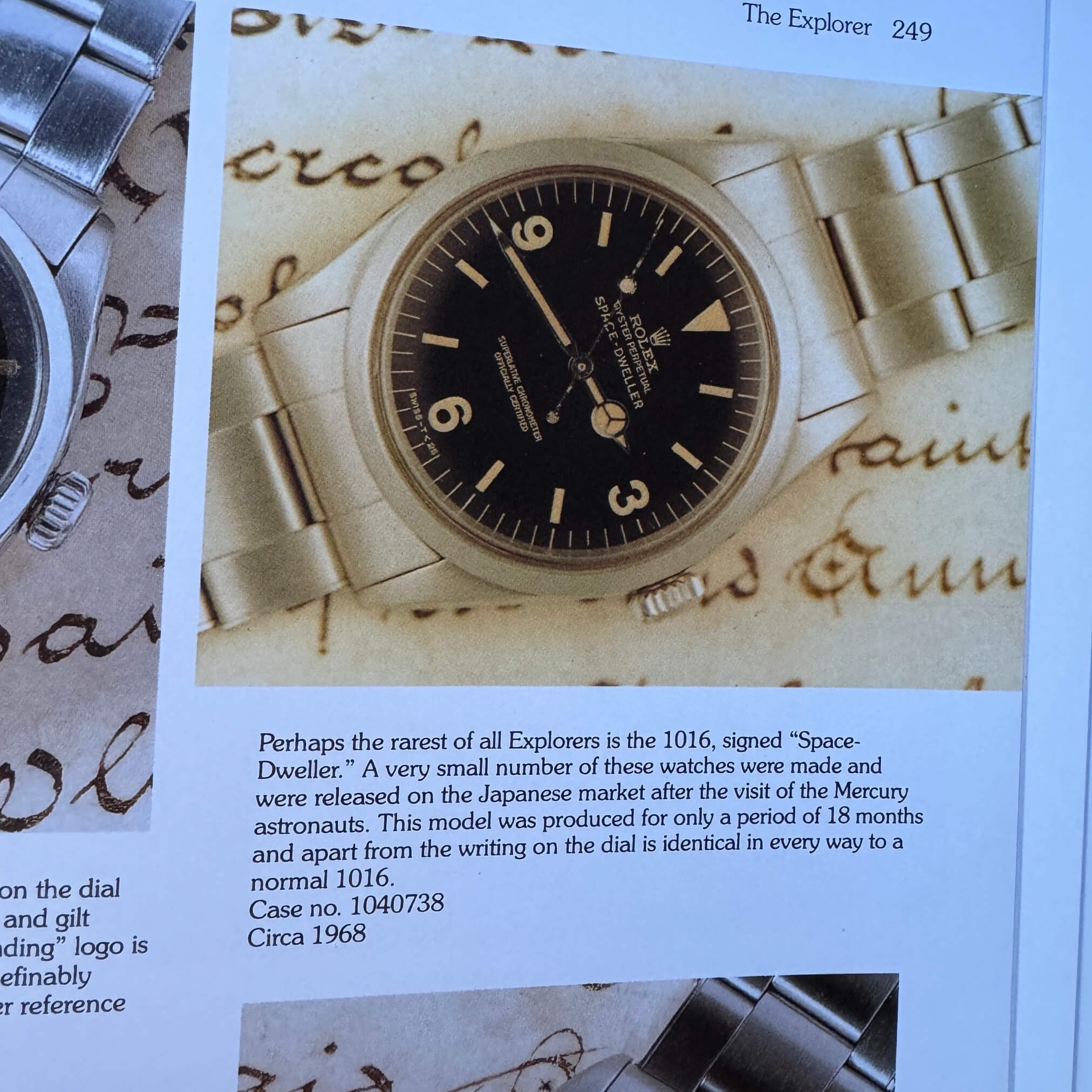

Recently, this temptation has shaken the watch industry on multiple occasions. For example, there’s the recent controversy surrounding the Rolex Deep Sea Special. There’s also the “Space-Dweller” that appeared to be not quite as advertised. Another example is an Omega Speedmaster that a few insiders engineered to reap a profit at auction. This last criminal undertaking is now under investigation. Yet, these are just a few examples of many. And what do all these cases have in common? They are just the ones that became known to the public. The real percentage of fraudulent auctions will forever be a mystery.

Wolfgang Beltracchi — a masterclass in fraud

Watches are just a small subset of auctions. When the news broke about the fraudulent Speedmaster last year, I immediately recalled the famous case of Wolfgang Beltracchi. Beltracchi, a German painter, is gifted in many ways – and he used these talents to make millions with fraudulent auctions by imitating the skills of famous and sought after painters from decades and centuries ago.

In short, he created brand-new paintings and pretended that they were unknown, recently resurfaced masterpieces by certain famous painters. Beltracchi forged these paintings with such mastery and attention to detail that even experts couldn’t distinguish them from the imitated painters’ bodies of work. Beltracchi took everything into account, from the right type of canvas and era-appropriate pigments to a fitting subject and an indistinguishable painting technique. The cherry on top was the believable storytelling surrounding the rediscovery of the paintings. It was a true masterclass in fraud and marketing from start to finish.

Well, almost. He was exposed as a fraud in 2010 when the London-based company Art Analysis & Research examined one of his paintings. Using state-of-the-art methods, AA&R detected modern paint on one of his forged works. It contained traces of titanium dioxide, which was not common in paint of the historical period. Beltracchi made one crucial mistake: instead of mixing the paint himself, which he usually did, he used an off-the-shelf tube of zinc white containing traces of titanium white. “May contain traces of nuts” is a label that comes to mind in the age of industrialization. Similarly, it seems that this titanium white was also produced at the same factory as the zinc white. The contamination didn’t lead to an allergic reaction, though. In this case, it led to a prison sentence.

Fighting fraud — who watches the watchmen?

This brings us to interesting question: what can be done to prevent or expose fraudulent auctions in the watch world? Looking at the case of Beltracchi, one has to wonder if that is reliably possible. The Speedmaster fraud case from last year emphasizes the question, although this particular forgery was much more easily exposed compared to Beltracchi’s works. But what about watches that are up to the level of a Beltracchi painting? Do such watches exist? Have such watches been auctioned? I don’t know. Thinking about the potential profits, though, I wouldn’t be terribly surprised if they have. That said, compared to highly desirable art pieces, watches might not (yet) be a sufficiently profitable niche.

In the grand scheme of things, it seems there are three main gatekeepers to keep fraud outside of auction houses — the auction houses themselves, experts within the watch community, and, finally, the law.

Legal authorities are now fully involved in Speedmaster case and also made sure that Beltracchi went behind bars for his actions. The law, of course, functions as a deterrent to prevent criminal activities. However, as has always been the case throughout human history, the law will not deter everyone, and only the people exposed as having committed a fraud will pay for their actions. In short, to face any consequences, they need to be caught first. And there will always be individuals who will believe that they won’t. This brings us to the two other lines of defense — auction houses and experts within the community.

Conflict of interest

Naturally, you would say that it is in the interest of auction houses to prevent fraud. Building trust is essential when dealing with high-value goods. To do that, auction houses work with both in-house specialists and third-party experts. This is crucial because of the breadth and depth of knowledge that is necessary to confidently make an assessment. If you keep in mind that multiple brands with multiple models spanning multiple decades need assessment, it quickly becomes clear what a Herculean task this is. Additionally, trustworthy documentation can be tricky to find, especially when it comes to vintage watches. Therefore, auction houses also may ask brands to assist with their archives or specialists from their museums in certain cases.

All of the above sounds great — a difficult but nevertheless trustworthy process. However, thinking back on the Speedmaster auction and recalling that, apparently, brand-level museum personnel colluded to allow the fraud to take place, we see that there can be multiple points of failure where you wouldn’t expect them. Additionally, having an auction is, of course, more profitable than having no auction. At the very least, we might wonder about a potential conflict of interest here. Despite that, even with all due diligence in place and the best of intentions, there remains a margin of error.

Watch-community experts

That brings us to the third and final category of fraud detection — experts within the watch community. As is often the case in other industries, ours is kept in check by enthusiasts who aren’t engaged for profit (or not exclusively) but out of love for their hobby. High-profile auctions tend to get their fair share of attention within the watch world. Consequently, they become subject to scrutiny by collectors, enthusiasts, and experts. Specialists like Jose from Perezcope immediately come to mind and not only because he was the one to quickly cry foul when he caught wind of irregularities with the Speedmaster auction mentioned before or, more recently, the Rolex “Space-Dweller.”

He is also one of the aforementioned external consultants for auction houses, proving that his expertise is widely acknowledged. The work of people like Jose is of immense value because keeps the industry in check. If it weren’t for external scrutiny, I reckon it would be far more tempting to try and get away with funny business. If you want to get an idea of some developments on that front, I can highly recommend that you follow Perezcope and read his articles. A word of caution, though: they’re not for the faint of heart. If you prefer to live with rose-tinted glasses on, his work might be a rude awakening.

Play the game, but play it well

I believe there are three ways to play the auction game while still managing your risk appropriately. First, either be certain that you trust the specific person responsible for the assessment of the lot that interests you or, second, be an expert yourself (easier said than done). The third option is to consult an expert who you trust. Can honest mistakes still happen? Yes. Is there a chance of a Beltracchi-level forgery that is nearly impossible to detect? There sure is. However, nothing in life comes without risk, and when applying the precautions mentioned above, one might argue that a well-managed risk is worth taking.

In conclusion, even though I highlighted many of the risks, I don’t think auctions need to be categorically avoided. I strongly believe in appropriate risk management, though. If interested bidders do their due diligence, I consider the risks in these kinds of auctions to not be out of proportion. However, depending on the value of the lot, that is a substantial “if.”

The good news is that it seems that this is predominantly an issue at the very high end of the spectrum, so only a tiny fraction of these auction could be affected. Furthermore, only a select few of us will ever likely face this risk. Nevetheless, it arguably does have a knock-on effect on the prices of certain models. This boomerangs back to the whole enthusiast community, and it is why brands are interested in the prestige that comes in tandem with high auction sums.

What’s your take on auctions? Do you follow other noteworthy experts like Jose who are worth mentioning? Let us know in the comments.