What Will Burst The Rolex Bubble? A Look Into A Very Murky Crystal Ball

Inflation and confidence in the market are both high, and these forces have a lot of impact on the watch market. This is especially true when there are also gray-market speculators and a shortage of watches that everyone seems to want. All these elements together create the Rolex fata morgana. But what would happen when one of these elements is taken away? What will burst the Rolex bubble? Let’s look for an answer.

Confidence is a good thing, especially when you wake up in the morning, look in the bathroom mirror, and walk away with a smile on your face. If you can take that confident feeling with you for the rest of the day, you will walk with a spring in your step. But when you confidently stride into the nearest Rolex dealer with money in your pocket for the new oddball GMT-Master II, your positivity is put to the test. Even for very self-confident people, a hard “no” and the absence of a “yes” on the horizon can destroy a positive feeling.

What will burst the Rolex bubble? Customer confidence sure won’t do that

Strangely enough, confidence is one of the reasons that you can’t actually buy that new GMT-Master II “Destro”. The Global Consumer Confidence Index was holding steady at 115 in Q4 2021. And to understand this number, it’s good to know that a figure above 100 is considered positive. Nowadays, consumers just feel too good about the overall state of the economy and their personal financial situations. Consumers who feel that way want to consume, snapping up the best-known and most prestigious luxury watches, for instance. As a result, demand outweighs the supply, and that again has led to a watch craze. And I do think “craze” is the right word when you see stainless steel Rolex watches being sold for three times the retail price.

Inflation versus timepiece

According to the Dutch Bureau of Statistics (CBS), the Netherlands’ annual inflation rate came down ever so slightly to 9.6 percent in April 2022 from 9.7 percent in the previous month. And that March number was the highest in nearly 47 years. The cost of living — the essentials — went up massively, but so did the cost of less essential products. I don’t want to infuriate all you passionate watch fans, but a luxury timepiece is not an essential product.

But as I said, consumer confidence is high despite a high inflation rate. And one way to protect yourself against inflation is by buying a luxury timepiece, one with a stable level of demand like a Rolex. Mechanical luxury watches have overcome the Quartz Crisis, and they also seem to do a pretty good job in fending off smartwatches. The prestige and status of a traditional watch causes it to retain its value. Even the younger generations have come to understand this.

The Rolex traveler’s check

Apart from an object that shows status, or the more refined idea that wearing a mechanical timepiece shows knowledge and appreciation of traditional craftsmanship, a watch is also a practical asset. You can carry your watch with you, have it serviced when needed to keep it in the best possible condition, and you can turn it into cash very easily. A Rolex is like an international traveler’s check that gets accepted everywhere in the world. And what is good to understand is that, especially with a Rolex, there is a bottom when it comes to cash value. Right now, the market for Rolex is booming, but if it ever stops doing that, the price you can get for your Rolex will never drop below a certain minimum. And that’s because traders will always be willing to buy your Rolex no matter the state of the economy.

A balancing act

What you see in today’s watch market is a balancing act between inflation and customer confidence. Confidence and inflation — two opposites — are both high, but the luxury watch is the stabilizing factor. It’s a delicate balancing act, however. Confident consumers spending money is the key. But what could kill their confidence? Well, if inflation continues to stay high and shows no signs of falling soon, choosing between wants and needs becomes a bit easier. After a while, the cost of living won’t leave room for even a “sure bet” on a watch. And there are also emotional factors like the fear of a new COVID outbreak in the fall, war on the European continent with a global effect, and perhaps also the tangible effects of climate change.

When people are not willing to spend money — be it on the gray market or at official dealers — first, the prices on the secondary markets go down, and second, the unobtainable Rolex models you so desire will appear in the shop windows again.

What will burst the Rolex bubble? Internal forces

During the pandemic, investors who didn’t care about luxury watches before suddenly saw an opportunity to make money. With the world opening up again, the opportunistic traders who over-leveraged themselves now find themselves in a bit of a pickle. They need to get rid of their acquired watches to meet financial obligations and/or to minimize their losses. The result will be lower prices on the gray market and eventually stock at the official dealers. Can you believe it? Maybe in the near future, you could actually buy the revamped Rolex Air-King you fell in love with after seeing it at Watches And Wonders 2022. And maybe in the more distant future, you could even buy it with a discount again. But please, don’t hold your breath for either of those.

It’s also worth noting that because of various reasons, watch buyers are now so frustrated with gray market prices and the unavailability of steel sports watches from Rolex that they have changed their behavior. It’s become a matter of “enough is enough”, you could say. Still, it took them long enough to reach that point. Prices will drop when the feeding frenzy of buyers dies down.

Looking into a murky crystal ball

I mentioned COVID as a possible negative effect. The past, however, showed that a lockdown had a positive effect on luxury goods. A lot of money that would have otherwise been spent on vacations, for instance, was now spent on the luxury-goods market. So, when we expect COVID to get a grip on the world, we feel bad, but once we are in its grip, we have nothing else to do but buy luxury watches (apparently). In that case, the display window will be empty again, and gray-market investors can start filling their pockets once more.

But maybe people with an interest in watches have learned a thing or two. One of these things could be that buying a watch everyone else wants is a very frustrating and often lackluster experience. If so, bloated prices on the secondary market will be kept in check. And the same goes for the frustrating phenomenon of waitlists. But please, don’t expect the Rolex bubble to burst with a bang and that immediately after, everything will be right as rain again. No, the bubble will slowly deflate; all you need is just a little patience — that’s what Axl Rose of Guns N’ Roses once sang, anyway.

Rolex availability

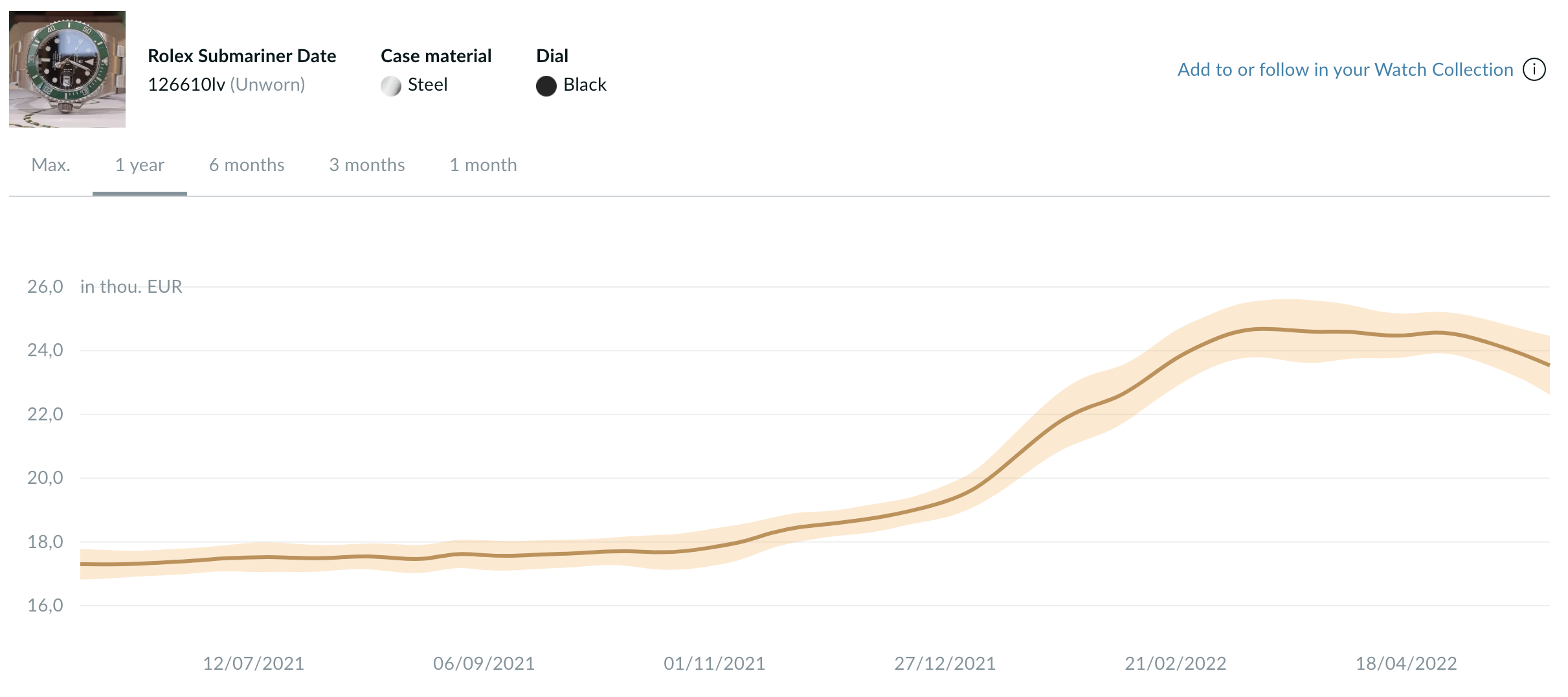

Have a look at the price development of the Submariner “Starbucks” on this graph that I found on the Watchcharts Instagram page. This is a watch that has a place in the current collection, and prices for it on the secondary market are falling. At Fratello, we would not be surprised that come 2023, Rolex sports watches will make a reappearance at authorized dealers. This could possibly be because of the picture I just painted, but also because the brand has worked hard to churn out more watches through an optimized production chain. On Chrono24, it becomes clear that the “Starbucks” is suffering. There are more than 400 Rolex Submariner 126610LV watches on offer and a plethora of other modern sports watches. The older models, the discontinued vintage ones, continue to go up in price. But that’s a discussion for another time.

Another point of interest

What about the influence of interest rates? Well, there is hope for savers at ING. If the European Central Bank (ECB) raises interest rates, ING will too. That’s what CEO Steven van Rijswijk said in an interview with Dutch TV show RTL Z. Interest rates are slowly rising and that’s good for savings and pensions, but bad for mortgages and loans. And that is likely to continue in the coming months. Central banks are expected to raise key interest rates and reduce massive debt purchases in order to curb sky-high inflation.

Who will notice all this? When your money can grow again — if ever so slowly at first — the need to buy a watch that holds its value becomes less interesting. So for the parallel market, rising rates are not a positive development. High interest rates also make it more expensive to borrow money, and this ensures that people and companies spend less money.

What will burst the Rolex bubble? Final words

Will the time come when collecting and buying watches will again be strictly a matter of passion? I don’t think so. Yes, when the market cools down and someone who wants a Submariner for all the ”right” reasons can buy one with hard-earned money again, you could say that things will have gone back to normal. But now that traders have experienced just how much money there is to be made on luxury watches, the craziness could happen all over again, especially when we’re dealing with a perfect storm. And let’s face it, the right mix of consumer confidence, inflation, and unmet demand (whether real or artificial) could happen again. History repeats itself, you know.

Please find and follow me at Lex Stolk • Instagram