Will Cartier Be The New Pearl In The LVMH Crown? — A Fratello Analysis

Bernard Arnault, the 74-year-old French entrepreneur with a staggering estimated net worth of around US$200 billion, is the driving force behind LVMH. He runs one of the most successful businesses in the luxury industry and rubs shoulders with presidents and other people in the highest places. The man that took over his father’s construction-turned-real-estate business when he was 30 built a luxurious empire that he constantly wants to extend. Not everything he does works out, though. For instance, Arnault failed to acquire French Maison Hermès. But rumor has it he has set his aim on another famous French house. Will Cartier be the new pearl in the LVMH crown?

Buying other companies seems to be on LVMH’s daily to-do list. In the last two months of the year, LVMH bought Italian online wines and spirits company Tannico, Art Lab, a Tuscan company specializing in digital printing and handmade treatments on leather, and Pedemonte Group, a jewelry producer operating in Italy and France. These brands maybe don’t immediately ring a bell, but they are strategically important to LVMH. In total, LVMH, founded in Paris in 1978, made 28 acquisitions worth US$44.01 billion and made 18 investments in multiple sectors such as fashion and beauty tech, online grocery, and more.

Will Cartier be the new pearl in the LVMH crown? — The failed attempt to acquire Hermès

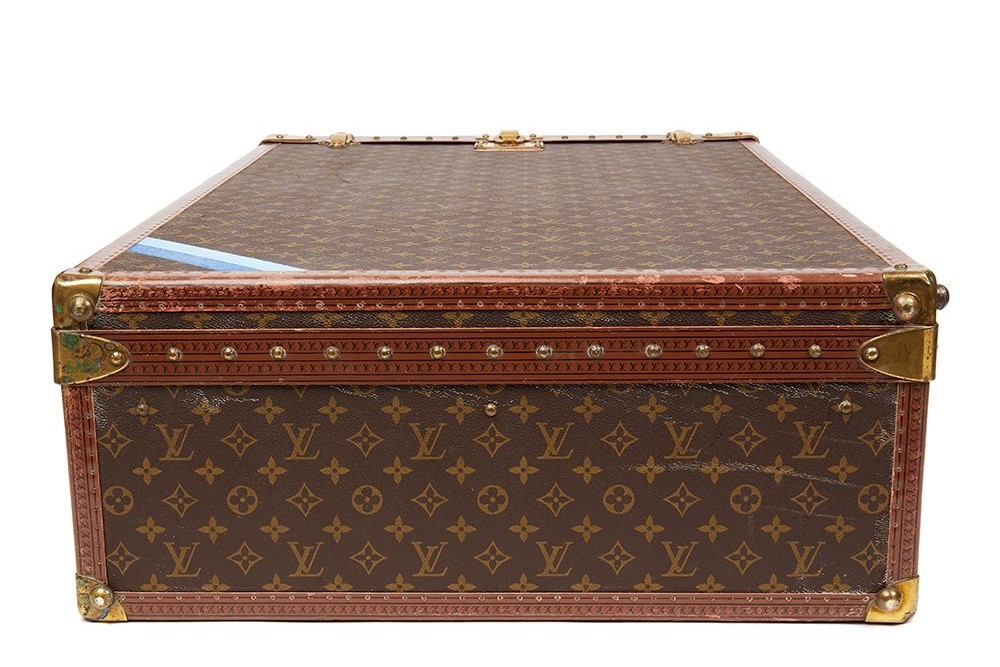

Prominent brands that recently joined the LVMH portfolio were, among others, jewelry house Tiffany & Co. in 2019 for US$16.20 billion and German luggage maker Rimowa in 2017 for US$716 million. Also in 2017, Arnault’s LVMH acquired the famous French fashion house Dior for US$13.1 billion. And when the name Dior drops, other leading French Maisons come to mind. Think Chanel, Cartier, and Hermès, names that are synonymous with French grandeur, prestige, style, heritage, and savoir-faire. Brands that would suit Arnault and his operation very well. With billions in the bank, you can obviously buy any Hermès product in the brand’s catalog. But billions also buy you complete brands, not just Birkin bags. That’s what Arnault thought, anyway, but that plan backfired horribly.

Luxury owned and enjoyed

Some experts and insiders describe Bernard Arnault as the flamboyant type. Well, he sure loves luxury. Not only does he sell a very wide of luxury products through a plethora of LVMH-owned brands, he also likes to enjoy luxury personally. Arnault owns and enjoys his castles, a private island in the Bahamas, villas all over the world, and an impressive art collection. Where does the funding come from originally? Bernard Arnault joined his father’s construction company in 1971, shifted its focus to real estate, and became its CEO when he 30. But he didn’t expand in the real estate sector. Instead, he went into luxury goods and left France. He took his business to the United States because the economic climate under President François Mitterrand at the time was not pro-capitalist, to say the least.

But Arnault came back and started to buy French luxury brands with a long tradition and a great story to tell but hardly any future, it seemed. He managed to turn dusty fashion brands like Louis Vuitton into hip and happening “it” brands. On his takeover path, Arnault also came across Hermès, the renowned luxury manufacturer that Thierry Hermès founded in 1837 in Paris’s Grands Boulevards quarter.

In October 2010, Patrick Thomas, the CEO of Hermès at the time, got an unexpected call from Arnault. First to his surprise but quite quickly also to his anger, Arnault told Thomas that LVMH would be announcing that it had acquired a 17% stake in Hermès. But the company, largely owned by the Dumas family, wouldn’t have any of it. To defend itself against a hostile acquisition, the family business Hermès set up a private holding company. According to The Fashion Law, that holding now owns 50.2% of Hermès shares and has first right of refusal when a family member decides to sell shares.

No, not Chanel

Chanel is in the same league as Hermès from a cultural and business perspective. Chairman Alain Wertheimer runs the company with his brother Gérard, and the two are grandchildren of Pierre Wertheimer, who founded the brand with Gabrielle “Coco” Chanel. But after the Hermès fiasco, trying to acquire Chanel would be a fruitless undertaking. In 2019, rumors circulated that Arnault wanted to take over Chanel, which was worth around US$100 billion, an amount of money that even Arnault regards as quite sizable. Alain and Gérard Wertheimer, who have a combined net worth of US$42 billion, are among the ten richest people in France, but they’re also quite secretive and elusive.

The brothers hardly ever speak to the press and surround themselves with other tight-lipped people. They have no reason to sell the iconic family brand that reported record revenues in 2021 of US$15.5 billion. And Chief Financial Officer Philippe Blondiaux said in the media that the brand expects “healthy” growth in 2022.

Johann Rupert’s soft spot

Cartier, “the jeweler of kings and the king of jewelers,” however, is not owned by a direct descendant of the brand’s founder Instead, it’s part of Compagnie Financière Richemont S.A., commonly known as Richemont. This Switzerland-based group was founded in 1988 by businessman Johann Rupert. According to Forbes, Rupert is the second-wealthiest man in South Africa in 2023, with a net worth of US$10.7 billion — “just” US$10.7 billion when you compare that to Bernard Arnault’s net worth of US$200 billion.

Rupert accumulated his fortune through the family’s tobacco business and also through Richemont SA, a publicly traded luxury goods manufacturer and retailer of which he is chairman. He also controls 10% of the company’s capital and holds 51% of its voting rights. One of Rupert’s characteristics is his deep commitment to some of the group’s watch brands. Panerai and A. Lange & Söhne, for instance, are brands that Rupert has a particular soft spot for.

Buy 20, get one “free”

Adding Cartier to the LVMH portfolio makes sense from Bernard Arnault’s French perspective – since 2007 Arnault is Commander of the French Legion of Honor after all. Just like Hermès, Cartier has a prestigious French heritage. The brand “deserves” a French owner, so to speak. But how, exactly, would he acquire the brand? By buying Richemont, the group that owns 20 luxury brands and reported revenues of €13.14 billion in 2021. It’s a bit like “buy 20 brands, get one free” if you will. But to make that happen, Arnault would have to persuade Rupert to give up the controlling stake in the company. And that might be a tough one.

In August of last year, Rupert didn’t give in to activist shareholder Bluebell Capital Partners’ wishes to change the boardroom structure.“Our board may be slower and more conservative than others. But its openness and collegiality are exactly its advantage. I will not be blackmailed,” he said in an interview with Swiss newspaper Finanz und Wirtschaft. “I can assure you of one thing: I will not change our capital structure,” Rupert also stated. Still, Bluebell Capital’s co-founder Giuseppe Bivona told Reuters that the fund’s campaign would continue as the Richemont board did not take into consideration the Class A shareholders who take the greatest financial risk.

Anton, Johann, and Anton Rupert Jr.

Still, Arnault is not an activist shareholder, and he can be very persuasive. Maybe the 72-year-old Johann Rupert might want to start thinking about taking things easy, although he’s two years younger than Arnault. Ten years ago, Rupert took a sabbatical year and was reappointed as Richemont’s Chairman in September 2014. A decade later, taking an infinite sabbatical doesn’t seem that strange.

Johann Rupert did transform his father Anton’s tobacco business into a luxury giant and force to be reckoned with, and giving that up is quite possibly not an easy thing to do. Also, Rupert does have three children who could succeed him, two daughters and a son. Of the three, son Anton Rupert Jr., on paper, seems to be the most likely candidate.

The undisputed king of luxury

Anton Jr. is the current director of Watchfinder, a Richemont company. In 2017, he was appointed to the board of Richemont as a non-executive director, and he’s also a member of the Strategic Security and Nominations Committee. Whether he wants to take over from his father and if his father thinks he’s capable of taking over the family-founded business is not public knowledge. And perhaps that unclarity might be the weak spot in Richemont’s armor that Arnault wants to take advantage of.

The determination to be the best and biggest shines through in everything Bernard Arnault does. Cartier would be the pearl in the LVMH crown, and Bernard Arnault would wear that crown like the undisputed king of luxury he most definitely is. It will be very hard for Johann Rupert to resist Arnault once he starts besieging the Richemont castle that holds the Cartier treasure. But who knows? Maybe Anton Rupert Jr. will be the knight in shining armor who saves the day for his family and Richemont.

Find and follow me at Lex Stolk • Instagram.