You Asked Us: Which Watches Hold Value?

Value appreciation, retention, and depreciation are often front and center in the minds of potential purchasers. They shouldn’t be, but they are. The truth is, that nobody knows for sure how a watch will perform on the resale market long term. Let’s dig into the reasons why that is and what purchases you can make in full confidence.

Firstly, don’t take anything you read on a website — much less a website that discusses a nuanced and changeable commodity like luxury wristwatches — as investment advice. This is not an investment guide. The same is true of any website analyzing the trends of pre-owned watches. It is an inexact science, to say the least. But there are some brands that have historically proven to perform better than others on the pre-loved market. There are no guarantees, but there are patterns that look likely to continue.

Genuine advice

I won’t tell you what to buy. I wouldn’t tell you what to buy if this were purely a discussion of taste. Since this is a question of value appreciation, I certainly won’t pin my colors to any mast (no matter how weather-beaten it may be). But I will give you two bits of genuine advice. This advice comes from the heart and is predicated on years of experience.

Number one

Number one: Don’t spend more than you can afford to lose. I picked up this nugget of wisdom at the poker table, and it’s never left me. The minute you go chasing that pot of gold at the end of a rainbow out of necessity, you are a loser. And you know what losers do better than anything else? They lose. Maybe not this time, maybe not the next time. But eventually, they all lose. So, succinctly, don’t be a loser.

Number two

Number two: Don’t look at watches as a financial investment. Instead, treat them as an emotional investment. I’ve been presented with the opportunity to buy “safe” appreciation pieces that I thoroughly hated in the past. I never bought a single one. Why? Because it is too risky. If you buy what you like, if you buy within your budget, and you buy with no intention of selling, you will never be disappointed. Don’t pull the trigger until you’ve done your research.

And I don’t just mean research into the model, the brand, and their shared history. Rather, I mean independent research into your own feelings. Are you comfortable with the purchase? Is it, in any way, a compromise? If you feel discomfort or are about to consciously plump for a model you don’t really want, walk away. There are loads of watches out there. And, quite ironically, an abundance of time. So take it. It will be worth the wait.

Sock drawer suckers

Let’s assume you know all this already. Let’s assume you’re not some over-eager greenhorn that thinks they can make a quick buck because they watched Antiques Roadshow at the weekend and saw some old dude unearth a treasure in his sock drawer. Those stories? They aren’t replicable. And, as more and more people become aware of the potential value of vintage watches, they will become rarer and rarer still.

Some of the industry’s best-loved classics were failures upon release. Sometimes, that’s exactly why they are rare. The “Paul Newman” Daytona? A perfect example. The Rolex Explorer II Reference 1655? Another initially unloved juggernaut. Nowadays, the awareness of a brand’s investment potential does one thing in the long-term: It destroys it.

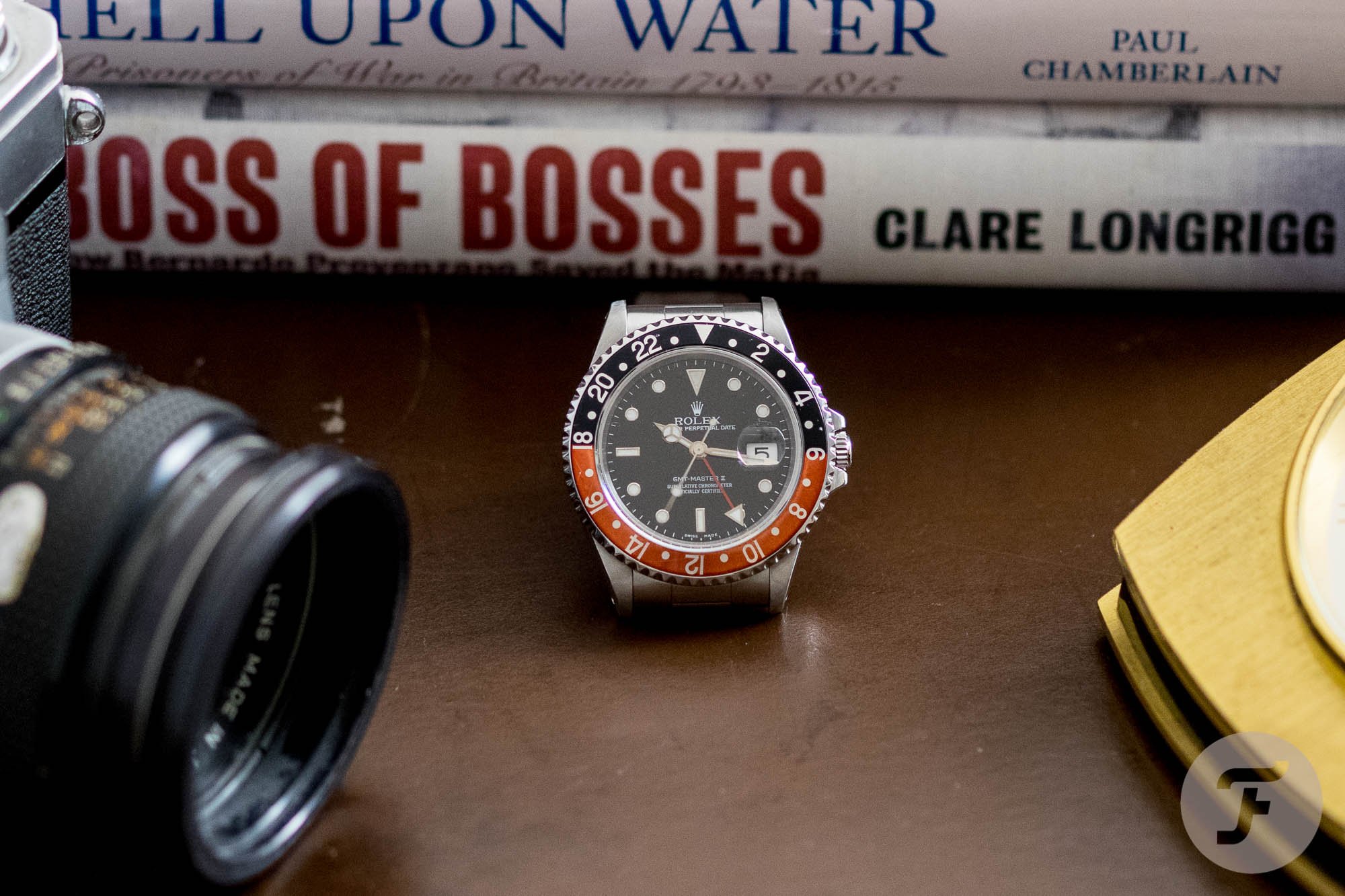

How many box-fresh Rolex GMT-Master II Reference 126710 “Pepsi” models do you think you’ll be able to find in ten years’ time? Loads, that’s how many. So many people are buying these models to hide them away in a safe. It’s a travesty but it’s the reality. If the scarcity of steel professional Rolexes continues these models may well continue to command huge amounts for those who cannot wait for an AD to pick one up, but they will not be the White Giraffes their forebears were. More likely, is that the next future classic in the Rolex catalog already exists and we’re not even looking at it. That makes buying what you like all the more important.

Take the plunge

So now you’re well-equipped with this value awareness, you’re more ready to take the plunge. What should you buy? Well, if getting a return on your investment is really something that matters to you and no amount of well-reasoned arguments can get you off, then go for quality first.

Tastes change. Trends come and go. Quality is eternal. Well made pieces with design integrity are more able to stand the test of time. Patek Philippe, Rolex, certain Audemars Piguet families hold-up well because these brands make the vast majority of components themselves, which means their aftersales provisions are vast.

For me, that’s where the true value of watchmaking resides.

Certain segments of the market have hugely evolved fanbases. This wouldn’t be a Fratello article if we didn’t point you in the direction of the Omega Speedmaster and its fun, passionate, and welcoming community. The really great thing about buying a Speedy is getting to join the club. An international network of appreciative like-minded folks will offer a far greater return on your investment than money can buy. For me, that’s where the true value of watchmaking resides. If you’re just in it for the money, buy gold bullion, property, or saffron (I have no idea if any of that is good advice so please don’t pump your life savings into the spice trade on my say so).

Most importantly, have fun with it. We’ll be there for the ride.

Follow me on Instagram @robnudds